Xilinx and Lam Research: First-Quarter Earnings Highlights

On April 24, Xilinx (XLNX) and Lam Research (LRCX) announced their fiscal earnings for the quarter.

Nov. 20 2020, Updated 4:51 p.m. ET

Xilinx’s earnings highlights

On April 24, Xilinx (XLNX) and Lam Research (LRCX) announced their fiscal earnings for the quarter, which ended in March 2019. For ease of comparison, we have converted the fiscal year quarters to the calendar year quarters.

Xilinx supplies FPGA (field programmable gate arrays) hardware and software solutions for various applications that need accelerated platforms. It started reporting double-digit YoY growth in the first quarter of calendar 2018 and benefitted from the early rollout of 5G (fifth generation) network in the second half of 2018.

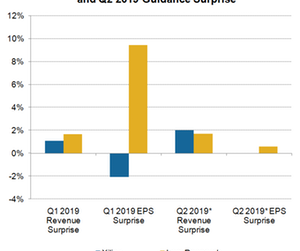

For the calendar first quarter, Xilinx’s revenue rose 23% YoY to $828 million, beating the consensus estimate of $819 million by 1.1%. Its non-GAAP (generally accepted accounting principles) EPS rose 34% YoY to $0.94 but missed the analysts’ estimate of $0.96 by 2.1%. Its revenue was driven by strong growth of advanced products in automotive and communications.

For the calendar second quarter, Xilinx expects its revenue to rise 24.2% YoY to $850 million at the midpoint, beating the consensus estimate of $833 million by 2%. Xilinx doesn’t provide EPS guidance, but analysts expect the company to report EPS of $0.92 in the calendar second quarter.

Xilinx to acquire Solarflare

Xilinx is acquiring high-performance, low-latency networking systems provider Solarflare Communications to expand its data center offerings. Similar acquisitions were announced by peer NVIDIA (NVDA), which is acquiring networking products supplier Mellanox to enhance its data center offerings.

Lam Research’s earnings highlights

Lam Research supplies manufacturing equipment to semiconductor manufacturers and earns 79% of its revenue from the memory market. The memory market is currently in a downturn, and many memory chipmakers cut down on their spending to reduce supply, which impacted Lam Research’s earnings. The company has been reporting YoY declines since the second half of 2018, and the recent earnings marked its third quarter of YoY declines.

For the calendar first quarter, Lam’s revenue fell 16% YoY to $2.44 billion, beating the consensus estimate of $2.4 billion. Its non-GAAP EPS fell 22.8% YoY to $3.7, beating the analysts’ estimate of $3.38 by 9.5%.

For the calendar second quarter, Lam expects its revenue to fall 25% YoY to $2.35 million, beating the consensus estimate of $2.31 billion. It expects EPS to fall 36% YoY to $3.4, more than the analysts’ estimate of $3.38.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!