Merck’s Stock Price Has Increased ~34% in 2018

On November 16, Merck’s stock price closed at $76.06, which represents ~1.63% growth from its close of $74.84 on November 15.

Nov. 20 2018, Published 1:10 p.m. ET

Stock performance

On November 16, Merck’s (MRK) stock price closed at $76.06, which represents ~1.63% growth from its close of $74.84 on November 15. Merck’s stock price grew from $56.79 when the market opened on January 2 to $76.06 when the market closed on November 16, which representing ~34% year-to-date growth. On November 16, Merck hit its 52-week high of $76.25.

On April 3, Merck hit the 52-week low of $52.83.

Merck’s financials

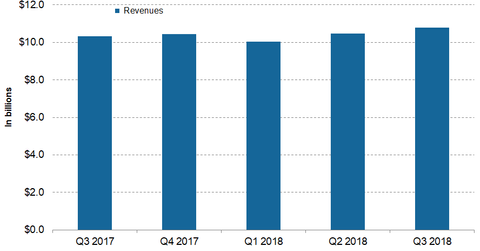

Merck’s net revenues during the first nine months of 2018 were $31.3 billion—compared to $29.7 billion during the same period in 2017, reflecting ~5% YoY (year-over-year) growth.

Wall Street analysts expect Merck to generate net revenues of $42.3 billion in 2018. Merck’s peers in the biopharmaceuticals market, Novartis (NVS), GlaxoSmithKline (GSK), and Johnson & Johnson (JNJ) generated revenues of $12.8 billion, $10.5 billion, and $20.3 billion, respectively, which reflects ~2.95%, ~2.78%, and ~3.55% YoY growth.

Merck’s net income and diluted EPS during the first nine months of 2018 were $4.4 billion and $1.63, respectively—compared to its net income and diluted EPS of $3.4 billion and $1.25 during the same period in 2017, which reflects ~28% and ~30% YoY growth.

Merck’s Keytruda, Gardasil/Gardasil 9, and Bridion increased its revenue growth during the first nine months of 2018. Keytruda, Gardasil/ Gardasil 9, and Bridion generated revenues of $5.0 billion, $2.3 billion, and $661.0 million, respectively, which reflects ~100%, ~38%, and ~33% YoY growth.

Read Who’s Eyeing Merck Now? to learn more about Merck. Merck and Johnson & Johnson’s (JNJ) revenue growth could boost the iShares Core High Dividend ETF’s (HDV) share prices. Merck and Johnson & Johnson account for ~4.12% and ~7.54% of HDV’s total portfolio holdings.

Analysts’ recommendations

Among the 18 analysts tracking Merck in November, six recommended a “strong buy,” nine recommended a “buy,” and three recommended a “hold.”

On November 19, Merck had a consensus 12-month target price of $79.12, which represents an ~4.02% return on investment over the next 12 months.