US Steel Companies Keep Fingers Crossed, Key Deadline Looms

U.S. Steel Corporation, AK Steel, Nucor, and Steel Dynamics will probably keep their fingers crossed as the “final” deadline approaches.

May 25 2018, Published 8:22 a.m. ET

US steel companies

On April 30, President Trump extended the Section 232 exemptions another month. As quoted by CNBC, the statement on the exemptions said, “The Administration is also extending negotiations with Canada, Mexico, and the European Union for a final 30 days. In all of these negotiations, the Administration is focused on quotas that will restrain imports, prevent transshipment, and protect the national security.”

Quotas

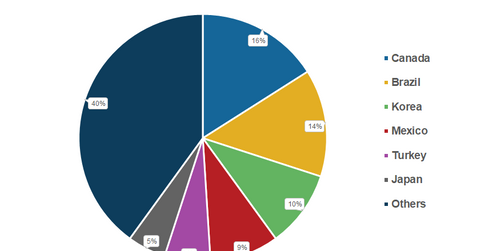

As noted previously, US steel imports have spiked despite the Section 232 tariffs (XME). The Trump Administration needs to impose quotas on exempt countries. US steel companies including U.S. Steel Corporation (X), AK Steel (AKS), Nucor (NUE), and Steel Dynamics (STLD) will probably keep their fingers crossed as the “final” deadline approaches for the Section 232 exemptions. We’ll have to wait and see how many quotas the Trump Administration manages to impose on NAFTA and the European Union. While President Trump has linked the Section 232 exemptions for Canada and Mexico to NAFTA renegotiation talks, other NAFTA countries have sought to delink the two.

More exemptions?

After the quotas for the European Union and NAFTA are sorted out, the Trump Administration might also have to deal with countries like Japan and India that are also seeking an exemption from the Section 232 tariffs. Notably, Japan is the only major US ally covered under the Section 232 tariffs. Read Could President Trump Get a Headache from Japan Soon? to learn more about the Section 232 exemptions.