Why Volatility Fell 16% in Week 1 of 2018

Every segment of the global financial markets began 2018 on a positive note. The global equity rally extended in the first week of the year.

Jan. 10 2018, Published 12:15 p.m. ET

Volatility begins 2018 on a weak note

Every segment of the global financial markets began 2018 on a positive note. The global equity rally of 2017 extended into the first week of the year. Commodity indexes (DBC) moved higher with the help of strong crude oil prices, and the high-yield bond markets moved higher. The only red flag was the volatility indexes falling when all the indexes began the year with a bang. There was even positive news from North Korea, with North and South Korea agreeing to engage in talks, which could be viewed as a step in the right direction.

US market performance

The US markets started 2018 strong with all the major US indexes posting impressive gains in the first week. Economic data for that week indicated expansion in manufacturing activity and a minor slowdown in the services sector. The Dow Jones Industrial Average (DOD) rose 2.3% in Week 1, while the S&P 500 (SPY) returned 2.6%. Technology stocks began 2018 on a strong footing with the technology-heavy NASDAQ index (QQQ) rising 3.4%.

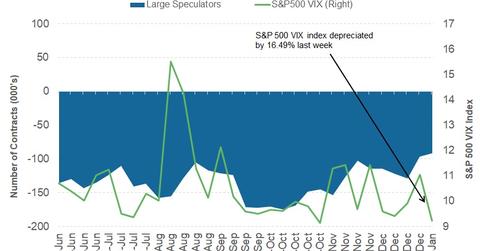

VIX and speculator positioning

The volatility index, or VIX (VXX), returned to weakness in Week 1 after posting three consecutive weekly gains. The S&P VIX 500 (VIXY) closed at 9.2, falling 9.2%. According to the latest COT (Commitment of Traders) Report released by the CFTC (Commodity Futures Trading Commission) on January 5, 2018, large speculators have decreased their net short positions from 97,130 to 91,557 contracts as of January 2, 2018. A steady rise in volatility in December 2017 could have led investors to pare their short positions, but last week’s fall could see another build-up in volatility short positions this week.

In the remaining parts of this series, we’ll review last week’s events and look at the outlook for various asset classes for the current week.