Micron’s Product Strategy for Fiscal 2018

In the DRAM market, Micron expects to achieve bit crossover on 1X DRAM by the end of 2018.

Jan. 19 2018, Updated 7:32 a.m. ET

Emerging market solutions

In the previous part of this series, we saw that Micron Technology (MU) focused on developing value-added memory solutions like SSD (solid-state drives) and graphics memory in fiscal 2017.

As we move toward the data-driven connected world, almost every electronic device would need memory. The advent of smart cities, smart homes, smart cars, and smart factories would require higher DRAM (dynamic random access memory) content to process large quantities of data at the edge.

Realizing that every application has its own memory requirement, Micron is working with various players in the emerging markets listed above to develop memory solutions.

Micron would focus on these emerging market solutions in 2018 and reveal these details at its 2018 Analyst Day.

Micron’s wafer manufacturing in fiscal 2018

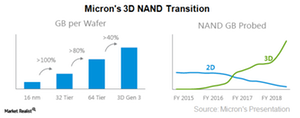

Apart from product technology, Micron is also developing manufacturing process technology. Micron is not spending on adding new capacity for DRAM or NAND. Instead, it is looking to increase its output by transitioning to advanced technology, which makes it cost-competitive ahead of Samsung (SSNLF) and SK Hynix.

In the DRAM market, Micron expects to achieve bit crossover on 1X DRAM by the end of 2018. Bit crossover signifies that a yield of 1X crossed that of the previous generation’s 20 nm (nanometer). It also expects to start initial production of 1Y DRAM in 2H18.

On the NAND front, Micron expects to achieve bit crossover on second-generation 64-layer 3D NAND by fiscal 2H18. It expects to start initial production of third-generation 3D NAND by 2H18.

Micron has invested in a new back-end facility in Taiwan (EWT) to ramp up assembly and test capacity by the end of fiscal 2018. This would improve the company’s efficiency and cost-effectiveness, helping it remain profitable even in a downturn.

As competition intensifies in the memory space, Intel (INTC) and Micron have ended their NAND partnership as the former reentered the memory market and became a rival of Micron.

In the next part of this series, we’ll explore the impact of the end of this partnership on Micron.