Could US Tax Reform Pose a Threat to Oil Prices?

US tax reform could pose a problem for oil bulls, as lower taxes on the energy sector could bring down breakeven costs for US oil producers.

Dec. 22 2017, Updated 1:31 p.m. ET

US crude oil

On December 21, 2017, US crude oil (USO) (USL) February futures rose 0.5% and settled at $58.36 per barrel. US tax reforms could pose a problem for oil bulls, as lower taxes on the energy sector could bring down breakeven costs for US oil producers. Moreover, provisions related to capital expenditure could encourage investments in oil drilling and production, boosting US crude oil production and pressuring prices.

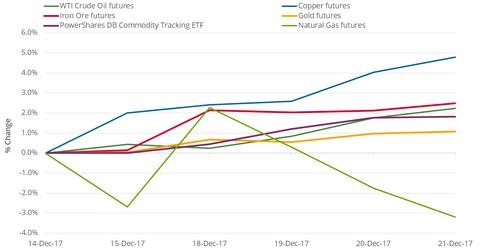

US oil production stood at ~9.8 MMbpd (million barrels per day) in the week ended December 15, 2017, a record high. Between December 14 and December 21, 2017, US crude oil’s February futures rose 2.2%. Equity indexes such as the S&P 500 (SPY) and the Dow Jones Industrial Average Index (DIA) rose 1.2% and 1.1%. In the next part of this series, we’ll discuss oil’s influence on these equity indexes.

Natural gas

On December 21, 2017, natural gas’s (UNG) (BOIL) January futures fell 1.5% and closed at ~$2.60 per MMBtu (million British thermal unit)—1.5% above their lowest closing price in 2017. On the same day, the EIA (U.S. Energy Information Administration) announced natural gas inventory data for the week ended December 15, 2017. There was a fall of 182 Bcf (billion cubic feet) in natural gas inventories. However, ithe fall failed to boost natural gas prices. In the trailing week, natural gas prices fell 3.2%.