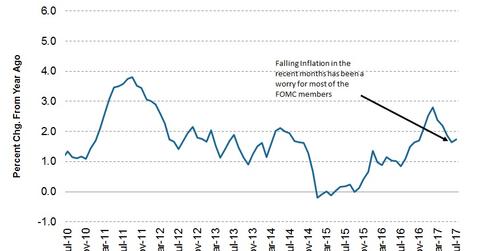

Here’s Why the US Inflation Rate Is Troubling the Fed

In its latest monetary policy statement, the Fed admitted it would take longer than expected for inflation to reach its 2.0% target.

Sep. 1 2017, Updated 12:35 p.m. ET

US inflation: The Fed’s major worry

In its latest monetary policy statement released after the July FOMC (Federal Open Market Committee) meeting, the Fed admitted it would take longer than expected for inflation (TIP) to reach its 2.0% target. The Fed started raising interest rates in December 2015 as the US economy gathered pace, but in the last three months, slowing inflation growth has stopped the Fed from aggressively tightening its policy. Inflation (VTIP) in the range of 2.0%–5.0% is considered healthy for any economy.

Why is inflation good?

Inflation means rising prices, so how can that be good for the economy? To understand the importance of inflation (SCHP), we need to know the opposite of inflation: deflation. If prices are falling, the economy is said to be in deflation. In that environment, consumers feel that prices are likely to go down further and avoid making new purchases, which reduces the demand for goods, and businesses reduce their inventories. As a chain reaction, companies produce less and hire fewer employees, which might lead to an increase in unemployment. That could become a vicious cycle, eventually leading to a recession.

The Fed in a wait-and-watch mode

As far as inflation (TDTT) is concerned, the Fed is in a wait-and-watch mode, hoping that inflation will pick up in the coming quarters. The interest rate is the primary tool to keep inflation (STIP) near the 2.0% target, so the Fed raises interest rates when inflation is rising quickly and lowers rates when inflation is falling.

The Fed is eager to move forward with its policy normalization plan, but lower levels of inflation are likely to keep the lid on further hikes, at least in the near term.