Host Hotels & Resorts’ Dividend Yield over the Years

Revenue and earnings Host Hotels & Resorts (HST), a hotel REIT, is involved in the possession and operation of US hotel properties. The company’s revenue was almost flat in 2015 and 2016, driven by rooms and food and beverages. Its operating costs and expenses rose 1%–2% in 2015 and 2016., while its interest expenses fell 32% […]

Sep. 18 2017, Updated 2:50 p.m. ET

Revenue and earnings

Host Hotels & Resorts (HST), a hotel REIT, is involved in the possession and operation of US hotel properties. The company’s revenue was almost flat in 2015 and 2016, driven by rooms and food and beverages.

Its operating costs and expenses rose 1%–2% in 2015 and 2016., while its interest expenses fell 32% in 2016 after rising 10% in 2015. Gains on the sale of assets contributed towards 38% EPS (earnings per share) growth in 2016 after a 23% fall in EPS in 2015. The company’s FFO (funds from operations) rose in 2016, after falling the year prior.

Revenue and EPS in 1H17

In 1H17, Host Hotels & Resorts’ revenue growth was flat. Its operating costs and expenses followed suit, falling just 1%, and its interest expenses rose 5%. A lower gain on the sale of assets led to a 30% fall in its EPS. Its FFO grew 2%.

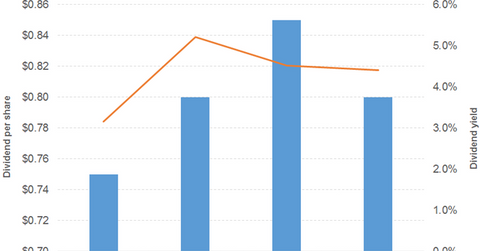

Dividend

Prior to 2017, the company had consistently increased its dividend. Its dividend payout rose between 1H16 and 1H17.

Stock price

Host Hotels & Resorts stock has been beaten by the Schwab US REIT ETF (SCHH) and the iShares Global Financials ETF (IXG) over the last three years.

The First Trust Dow Jones Global Select Dividend Index ETF (FGD) offers a dividend yield of 4%, at a PE (price-to-earnings) ratio of 14.5x. It has major exposure to Europe, and a 40%, 15%, 3%, and 2% exposure to the financial, consumer cyclical, consumer non-cyclical, and real estate spaces, respectively. The Vanguard International High Dividend Yield Index ETF (VYMI) offers a 2.9% dividend yield, at a PE ratio of 17.2x. It has major exposure to Europe, and a 35%, 10%, 7%, and 2% exposure to the financial, consumer non-cyclical, consumer cyclical, and real estate spaces, respectively.