Brazil’s Manufacturing Activity Is Improving with Rising Demand

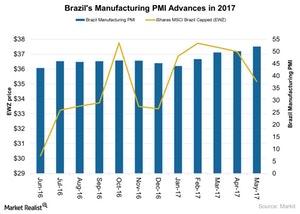

The Markit Brazil Manufacturing PMI rose to 52 in May 2017 compared to 50.1 in April 2017.

Jun. 29 2017, Updated 9:06 a.m. ET

Brazil’s political turbulence

Brazil (EWZ) continues to battle high levels of unemployment and political instability in 2017. Brazil’s interim president, Michel Temer, is fighting allegations of involvement in corruption and bribery, which has led to an unclear picture of the country’s political climate. These allegations and possible consequences could impact Temer’s reform initiatives.

Despite these setbacks, Brazil’s (BRZU) manufacturing activity improved in May 2017, mostly supported by improved demand conditions. Let’s look at the manufacturing activity over the last year, as shown in the chart below.

Output reaches four-year peak

The Markit Brazil Manufacturing PMI rose to 52 in May 2017 compared to 50.1 in April 2017. The manufacturing activity in May beat market expectations of 50.5. Manufacturing activity in May 2017 indicated the strongest expansion since February 2013.

New orders increased in May 2017, followed by a sharp rise in production in the last five years. New business, which forms the largest component of the PMI, grew at its fastest pace in the last four years. New orders increased as global demand showed improvement in May.

New business grew in international markets like Europe (HEDJ) (VGK) and within the Latin American (ILF) region. Brazil’s exports (EWZ) increased 12.6% year-over-year in May 2017, mainly due to increased sales of semi-manufactured products.

Purchases and employment

Purchasing activity also experienced strong growth in the last three years, and job shedding hit the lowest rate in the last couple of years. On the price front, input costs continued to increase due to the expensive import of raw materials, resulting from a weaker Brazilian real against the US dollar (UUP) (USDU).

Investment impact

Investors need to closely watch current political developments in Brazil (BRAZ), which can influence the country’s investment climate. Crucial economic reforms are expected to be delayed in Brazil due to the allegations against Temer.

In the final article in this series, we’ll look at Brazil’s service sector activity in May 2017.