KKR’s 2Q17 Performance on Deployments, Rise in Holdings

In 1Q17, KKR & Co. (KKR) deployed ~$5.4 billion in its Public Markets and Private Markets segments. KKR is expected to post EPS of $0.49 in 2Q17 and $2.15 in fiscal 2017, representing year-over-year growth of 113% and 216%, respectively.

May 18 2017, Published 5:54 p.m. ET

Expected performance in 2Q17

KKR & Co. (KKR) seems to have a positive outlook on private markets. The company deployed ~$5.4 billion in 1Q17 in two segments—Public Markets and Private Markets. The company has adopted a broad-based strategy, with 65% coming from its Private Markets division.

KKR is expected to post earnings per share (or EPS) of $0.49 in 2Q17 and $2.15 in fiscal 2017, representing growth of 113% and 216% YoY (year-over-year), respectively. This trend is backed by strong growth in its Private Markets portfolio, higher performance income, public market holdings, revival in credit holdings, and strong expense management.

In 1Q17, the company beat its revenue estimate of ~$291.9 million by posting revenues of ~$375.5 million, which represents 34.2% growth on a YoY basis.

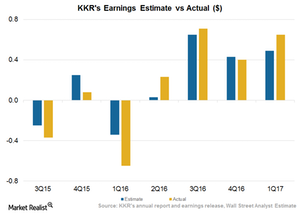

In 1Q17, KKR beat estimates by posting EPS of $0.65 compared to the analyst estimate of $0.49, mainly due to strong performance in its divisions. KKR’s strategic initiatives of fundraising and a rise in broad markets (SPY) (SPX-INDEX) has helped the company raise record funds.

KKR reported an increase in net income to $259.3 million in 1Q17 compared to its 4Q16 net income of $171.0 million. The rise in net income was driven by higher performance and investment income.

Upcoming deal in KKR’s hedge fund business

KKR & Co. (KKR) is expected to show improved numbers in the current quarter, including a major contribution from its hedge fund business and Private Markets segment. This contribution would be partially offset by the subdued performance of its Public Markets segment.

The deal of merging the company’s Prisma hedge fund with PAAMCO[1. Pacific Alternative Asset Management Company] is expected to close in 2Q17. This deal could provide tough competition to other players operating in the hedge fund business, including Blackstone Group, Apollo Global Management, and Carlyle Group.

Apollo Global Management (APO), Carlyle Group (CG), and Blackstone Group (BX) together constitute 4.1% of the PowerShares Global Listed Private Equity ETF (PSP).

In this series, we’ll study KKR’s expected performance, payouts, growth outlook, valuations, and ratings for 2017.