Market Focus: Time to Retest Emerging Market Waters

Emerging markets (VWO) have been on a tear this year! The past few years saw the asset class languish under fears of an economic downturn in China (YINN)(FXI), a US rate hike by the Federal Reserve, current account deficits, and currency volatility.

Sep. 8 2016, Published 12:10 p.m. ET

Market Focus: Retest EM Waters?

The current trend in the market has been the strong out performance of emerging markets quarter to date. Emerging markets have been on a tear, up 10.25% QTD versus 4.62% of the US Large Cap. What’s supporting this current trend?

Market participants are expecting one rate hike for the calendar year, at most. Payroll numbers have been relatively strong as of the last two reports, but mixed retail data continues to suggest yet another hold on a Fed hike.

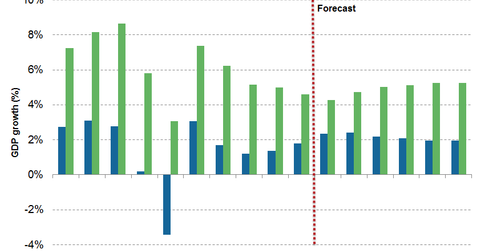

Market Realist – Emerging markets (VWO) have seen dramatic GDP growth this year. The past few years saw the asset class languish under fears of an economic downturn in China (YINN)(FXI), a US rate hike by the Federal Reserve, current account deficits, and currency volatility. However, investors seem to have shrugged off these worries as the global growth slowdown becomes conspicuous in this yield-starved world. The graph above shows how emerging markets are predicted to outstrip developed markets (EFA)(DZK) in terms of GDP growth in the coming years.

The iShares MSCI Emerging Markets Index ETF (EEM), the most popular emerging market ETF, fell 5.5% in 2013, 0.05% in 2014, and 15.1% in 2015. It seems to be in the green again. EEM has grown ~15% so far in 2016, outclassing the SPDR S&P 500 ETF (SPY), which has grown ~7% (sources: ETF Trends, Zacks).

The turn in fortune for emerging market stocks (EDC) has prompted investors to retest the waters. According to reports by the Institute of International Finance (the IIF), net inflows to emerging market portfolios have exceeded the $20 billion mark for three consecutive months. The IIF estimated net inflows to emerging market portfolios to be $21.6 billion in June, $29.8 billion in July, and $24.6 billion in August 2016.

During the three-week period ending August 17, 2016, EM net inflows “reached the highest level of representation in global mutual funds and ETFs in more than a year.” According to the IIF, emerging Asia was the biggest draw for investors, with inflows of $17.1 billion in August (sources: Reuters, IIF).

Investors could find value in emerging Asia. Not only has the region’s importance grown phenomenally over the past few years, but the growth stories remain robust. In Q2 2016, Indonesia’s GDP grew 5.2%, the Philippines’ grew 7%, and China’s grew 6.7%. India (EPI)(INDL) posted an impressive 7.9% GDP growth rate in Q1 2016 and 7.1% in Q2 2016.

Read on to the next part of this series to learn why investors could continue to favor emerging markets in the long term.