How Did Marvell Technology Compare to Its Peers?

Marvell Technology was outperformed by its peers based on the gross profit margin and PBV ratio. ETFs outperformed it based on the price movement and PBV ratio.

Sep. 15 2015, Published 11:13 a.m. ET

Marvell Technology and its competitors

An analysis of Marvell’s Technology’s (MRVL) income statement in 2Q16 is provided below.

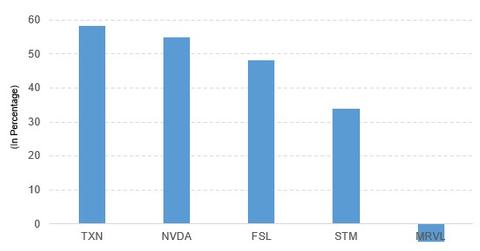

- The gross profit margins of Marvell Technology, STMicroelectronics NV (STM), NVIDIA (NVDA), Freescale Semiconductors (FSL), and Texas Instruments (TXN) are -5.20%, 33.81%, 54.99%, 48.08%, and 58.20%, respectively.

An analysis of Marvell’s valuation follows:

- The PBV (price-to-book value) ratios of Marvell Technology, STMicroelectronics NV, NVIDIA, and Texas Instruments are 0.89x, 1.37x, 2.93x, and 4.84x, respectively.

According to the above findings, Marvell Technology was outperformed by its peers based on the gross profit margin and PBV ratio.

ETFs that invest in Marvell Technology

The SPDR S&P Semiconductor ETF (XSD) invests 2.50% of its holdings in Marvell. XSD tracks an equal-weighted index of semiconductor stocks.

The iShares PHLX Semiconductor ETF (SOXX) invests 2.02% of its holdings in Marvell Technology. SOXX tracks a modified market-cap-weighted index of US-listed semiconductor companies.

The First Trust Technology AlphaDEX ETF (FXL) invests 1.48% of its holdings in Marvell. FXL tracks a tiered and equal-weighted index of US technology firms.

Marvell Technology and its ETFs

An analysis of Marvell’s price movement follows:

- The YTD (year-to-date) price movements of Marvell Technology, XSD, SOXX, and FXL are -38.55%, -2.32%, -9.49%, and -4.96%, respectively.

An analysis of Marvell’s valuation follows:

- The PBV ratios of Marvell Technology, XSD, SOXX, and FXL are 0.89x, 2.51x, 3.28x, and 2.98x, respectively.

As a result, ETFs outperformed Marvell Technology based on the price movement and PBV ratio.