Rate Hike Expectations: How They Shape the Price of Gold

An interest rate hike by the Fed will lead to pressure on the price of gold. When alternative investments are attractive due to an increase in the interest rate, money flows from gold.

Jul. 30 2015, Updated 4:01 a.m. ET

The Fed’s dual mandate

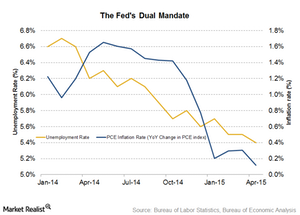

The Federal Reserve has a dual mandate of maximum employment and stable prices. In order to meet both of these long-term objectives, the Fed needs to balance the respective effects of a monetary move on inflation and changes in unemployment.

While labor market factors are moving in favor of a rate hike, the inflation side isn’t consistently growing toward the Fed’s target to warrant a rate hike.

The above chart shows the progression of the Fed’s dual mandate.

Rate hike expectations

When 2015 began, market consensus was for a Fed rate hike by June. But as time progressed, weakness persisted in the US economy. The second reading for the first quarter’s GDP (gross domestic product) came in at -0.7%. Consumer spending remained weak, and exports contracted. Other indicators also painted a mixed picture of the US economy. This led market participants to defer their expectations of a rate hike to later in the year or even to 2016.

Not many participants were expecting a rate hike in June before the FOMC (Federal Open Market Committee) meeting, but they were looking for a clear signal on the path forward for a rate hike. We’ll look at this in detail in the next part of this series.

Fed interest rate hike and gold

So how does this affect gold? Gold doesn’t offer anything in terms of regular income. In fact, it has a negative cost of carry for insurance and storage. So any increase in the attractiveness of alternative investments due to an increase in the interest rate would lead money flowing from gold to these investments.

An interest rate hike by the Fed will lead to pressure on the price of gold (GLD) and gold stocks, including Newmont Mining (NEM), Kinross Gold (KGC), and Yamana Gold (AUY). ETFs like the Gold Miners Index (GDX) that invest in these gold stocks would also be negatively impacted. These three companies form 13.0% of GDX’s holdings.

In the next part of this series, we’ll see how the Fed assessed the variables and what needs to be in place in order for the Fed to consider a rate hike.