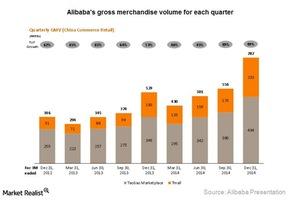

Alibaba’s Gross Merchandise Volume Continued to Grow

Across its China retail marketplaces, Alibaba’s gross merchandise volume grew by 49% YoY. It was driven by strength in Taobao Marketplace and Tmall.com.

Mar. 23 2015, Updated 4:05 p.m. ET

Alibaba’s gross merchandise volume

Gross merchandise volume, or GMV, refers to total sales volumes in dollar value for merchandise sold through a marketplace for a given period of time.

Across its China retail marketplaces, Alibaba’s (BABA) GMV grew by 49% year-over-year, or YoY. It was driven by strength in both Taobao Marketplace and Tmall.com. Similarly, Amazon (AMZN) saw a 30% increase in its third party sales in 4Q14. In contrast, eBay’s (EBAY) GMV declined in the fourth quarter due to a decline in new buyers. It was impacted by the cyberattack and Google’s SEO (search engine optimization) changes.

Taobao is the online marketplace for Chinese consumers looking for choice, value, and convenience. It features hundreds of millions of product and service listings. According to iResearch, Taobao Marketplace was China’s largest online shopping destination in terms of gross merchandise volume in 2013.

Tmall.com was launched in 2008. It provides a premium shopping experience for increasingly sophisticated Chinese consumers in search of top-quality branded merchandise. A large number of international and Chinese brands and retailers established storefronts on Tmall.com. According to iResearch, Tmall.com was the largest brands and retail platform in China in terms of GMV in 2013.

GMV growth was driven by increased active buyers

For the quarter ending in December 2014, Alibaba achieved $127 billion in China retail GMV. For calendar year 2014, Alibaba achieved $370 billion in China retail GMV. A key reason for the strong GMV growth is the continued growth in active buyers across its platforms—Taobao Marketplace and Tmall.com. The company explained that an active buyer is someone who came to its retail marketplaces to make at least one purchase during the period of measurement.

The GMV growth was also driven by category expansion. On November 11, 2014, the company’s Singles Day promotion generated GMV of $9.2 billion. This was an increase of 58% compared to the Singles Day in 2013. These transactions were settled through Alipay on its retail marketplaces within a 24-hour period.

Alibaba launched Alipay in 2004. It’s a third-party online payment solution that provides an easy, safe, and secure way for millions of individuals and businesses to make and receive payments online.

Management believes that GMV will continue to grow as the company continues to acquire new customers, especially in the low tier cities. In these cities, there’s still lot of potential to grow the user base.

For diversified exposure to Amazon, investors can consider an ETF like the Consumer Discretionary Select Sector SPDR (XLY). XLY invests 6.3% of its holdings in Amazon. For diversified exposure to Chinese stocks, investors can consider ETFs like the iShares China Large-Cap ETF (FXI). This ETF invests in the largest companies in China’s equity market. The financial services sector makes up 39% of FXI’s portfolio.