Anadarko Petroleum’s Free Cash Flow Forecast

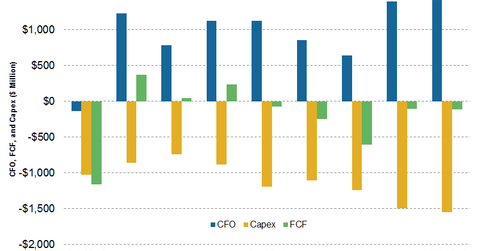

Anadarko Petroleum’s capex has mainly been showing an increasing trend since the first quarter of 2016. The free cash flow has been negative.

Nov. 20 2020, Updated 1:25 p.m. ET

Anadarko Petroleum’s cash flow

In the first quarter, Anadarko Petroleum (APC) reported a cash flow from operations of $1.43 billion—compared to operating cash flows of $1.12 billion in the first quarter of 2017.

Anadarko Petroleum’s operating cash flows were higher due to higher oil revenues from higher realized oil prices. Higher revenues in the first quarter were offset by less of a decrease in accounts receivables—$23 million in the first quarter of 2018 compared to $68 million in the first quarter of 2017. The higher revenues were also offset by less of an increase in accounts payables—$45 million in the first quarter of 2018 compared to $395 million in the first quarter of 2017.

Capex and free cash flow trends

As you can see in the above graph, Anadarko Petroleum’s capex has mainly been showing an increasing trend since the first quarter of 2016. The company’s free cash flow has mainly been negative.

Anadarko Petroleum’s management expects to post positive free cash flow in 2018 even as it ramps up production in the second half of the year in the Delaware Basin. Anadarko Petroleum could have higher operating cash flows and eventually positive free cash flows.

Using the free cash flow

Anadarko Petroleum’s management intends to utilize its free cash flow to fund share repurchases, dividend increases, and debt reduction. Currently, the company is in the middle of a $3 billion share repurchase program.

Recently, Devon Energy (DVN) announced a $1 billion share repurchase program, which it increased to $4 billion. ConocoPhillips (COP) increased its share repurchase program 33% in the first quarter, which brought it to share repurchases of $2 billion in fiscal 2018. Pioneer Natural Resources (PXD) also announced a $100 million share repurchase program at the beginning of the year. Noble Energy (NBL) announced a $750 million share repurchase program.