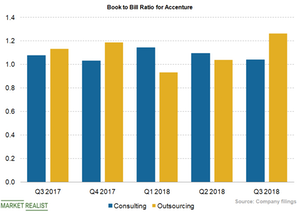

Accenture Maintains a Higher Book-to-Bill Ratio

In the last five quarters, Accenture’s book-to-bill ratio has always remained above 1, which is a healthy sign for its business.

Jul. 20 2018, Updated 9:01 a.m. ET

Book-to-bill ratio above 1

Accenture (ACN) continues to witness a high book-to-bill ratio. In the last five quarters, the company’s book-to-bill ratio has always remained above 1, which is a healthy sign for its business.

Such a level indicates that the company is winning a huge number of deals, which will drive its future revenue. Strong growth in ACN’s overall bookings has contributed to its healthy book-to-bill ratio.

In the graph above, we can see the book-to-bill ratio trend of Accenture’s consulting and outsourcing businesses over the last five quarters. During the period, the book-to-bill ratio for both operations mostly remained above 1.

In the last five quarters, overall net bookings for the company increased at a CAGR (compound annual growth rate) of 4.7%.

Factors influencing the book-to-bill ratio

Accenture Interactive, Applied Intelligence, Industry X.0, and the cloud and security businesses contributed ~60% of the company’s total new bookings in the fiscal third quarter. The company’s healthy bookings trend continues to gain from the signing of a higher number of contracts and the increased renewal of deals. Moreover, the ongoing migration of data from on-premises data warehouses to the cloud has also helped Accenture to generate strong bookings growth in the last five quarters.

In the reported period, the company signed ~13 deals of over $100 million, which helped it boost its book-to-bill ratio significantly.

Accenture continues to invest heavily in new products and services, which in turn may not only drive new bookings for the company but also downplay competition from other big IT players such as IBM (IBM) and Microsoft (MSFT). Accenture has some huge deals in its pipeline that could further drive its business going forward.