Bernstein: Income-Oriented Investors Should Worry about Inflation

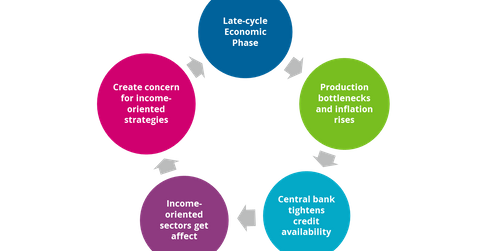

In the late-cycle phase, production activity shows blockages, inflation shoots up, and the central bank tightens credit availability.

Mar. 19 2018, Updated 11:35 a.m. ET

Bernstein on income-oriented investors

In the last two articles, we learned that billionaire investor Richard Bernstein is concerned about the inflationary situation and income-oriented strategies. He also said that the Trump administration’s recent announcement of the imposition of tariffs could further increase inflation in the US economy.

Late-cycle phase of the economy

In the present environment, the US economy (SPY) is in the late-cycle phase. The economic cycle generally goes through three different phases: early cycle, mid-cycle, and late cycle. In the late-cycle phase, production activity shows blockages, inflation shoots up, and the central bank tightens credit availability.

In such a scenario, the implementation of tariffs could create more concern for income-oriented investors. As these investors aren’t positioned perfectly to handle rising inflationary conditions, Bernstein believes that they should be more concerned about inflation. He said, “The performance of popular fixed-income and equity income strategies has been miserable since inflation expectations troughed in June 2016.”

The S&P 500 Index (SPY) and the Dow Jones Industrial Average Index (DIA) have risen 31.1% and 39.3%, respectively, from June 2016 to the present. However, the bond markets showed poor performances during the same period. Bernstein added, “The risks in the financial markets are not from inflation. Rather, the risk is that most investors are very poorly positioned for the changing inflation environment, which now includes tariffs.”

For more information, you may want to read