Duke Energy and Southern Company’s Current Valuations

Top utility stocks Duke Energy (DUK) and Southern Company (SO) are trading at an EV-to-EBITDA valuation multiple of 11.4x and 10.5, respectively.

Oct. 9 2019, Updated 9:54 p.m. ET

Valuation

On February 6, 2018, broader utilities (XLU) (IDU) were trading at an EV-to-EBITDA valuation multiple of ~10.5x. Utilities’ current valuations are higher than their five-year average valuation multiples—even after a decent correction. Top utility stocks Duke Energy (DUK) and Southern Company (SO) are trading at an EV-to-EBITDA valuation multiple of 11.4x and 10.5, respectively.

From a PE (price-to-earnings) valuation perspective, broader utilities seem to be fairly valued at a multiple of 14x. Their historical average PE multiple is ~14x.

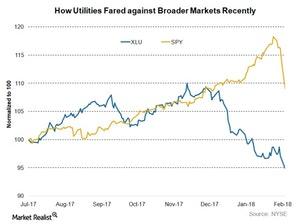

The above chart shows the comparative stock price movement of utilities and broader markets. Utilities witnessed a much faster recovery in a few instances last year after correcting 4%–5%. However, the current weakness seems to be much more stringent.

For a weekly synopsis on utilities (IDU), read How Utilities Fared during Market Turmoil Last Week.