Where Does Broadcom Call Home?

Tax office in Singapore Broadcom (AVGO), which has proposed to acquire Qualcomm (QCOM), currently maintains large corporate offices in both the United States and Singapore. However, Broadcom is incorporated as a Singaporean company, so its tax office is in Singapore. Last year, the company said that it was considering shifting its corporate headquarters, or tax base, to […]

Dec. 4 2020, Updated 10:52 a.m. ET

Tax office in Singapore

Broadcom (AVGO), which has proposed to acquire Qualcomm (QCOM), currently maintains large corporate offices in both the United States and Singapore. However, Broadcom is incorporated as a Singaporean company, so its tax office is in Singapore. Last year, the company said that it was considering shifting its corporate headquarters, or tax base, to the United States from Singapore. Broadcom has already started the process of reincorporating in the United States, which is usually a fairly long process.

Merger deals blocked on national security grounds

The issue of where Broadcom has its home has come up in the company’s ongoing tussle with Qualcomm. Broadcom offered to acquire Qualcomm for about $130 billion, but Qualcomm’s board quickly rebuffed it.

In a recent letter to shareholders, Qualcomm suggested that even if Broadcom were to force it into a merger deal, the deal would face significant regulatory hurdles in the United States because of national security issues—Broadcom is not considered a US corporation.

In September 2017, the Committee on Foreign Investment in the United States (or CFIUS) blocked the sale of Lattice Semiconductor (LSCC) to a group of Chinese investors on national security grounds. CFIUS also recently blocked the sale of MoneyGram (MGI) to Ant Financial, a fintech company affiliated with China’s e-commerce giant, Alibaba (BABA).

Tax cut in the United States

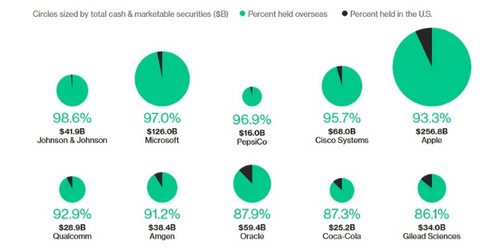

Broadcom shared its plan to reincorporate in America at a time when the US Congress was in the process of overhauling the tax law to introduce tax cuts. The Congress cut the corporate tax rate on profits generated domestically to 21% from 35%. The tax rate on foreign profits was slashed to 8.0%–15.5%. American companies such as Apple (AAPL), Microsoft (MSFT), and Oracle (ORCL) are expected to use the tax cut to repatriate profits they accumulated abroad.