Commodities Are Strong in the Early Hours on January 26

At 4:00 AM EST on January 26, the West Texas Intermediate crude oil futures for March 2018 delivery were trading at $65.44 per barrel—a drop of 0.11%.

Jan. 26 2018, Published 9:37 a.m. ET

Crude oil

After breaking the four-week gaining streak last week, crude oil started this week on a mixed note. Amid improved sentiment, crude oil rallied as the week progressed. On January 26, crude oil opened the day higher and traded above opening prices with strength in the early hours.

Market sentiment

The long-term sentiment on the crude oil market is strong amid optimism about global oil demand growth. Major oil producers’ willingness to extend the supply cut agreement beyond 2018 if needed added stability to the market. Increased US oil production is countering the upward sentiment. Read Is US Crude Oil Production near an All-Time High? to learn more about US crude oil production. On Thursday, crude oil rose due to a larger-than-expected decline in US crude oil inventories. However, the US dollar’s rebound offset the strength. The weaker dollar at three-year low levels is supporting oil prices in the early hours today.

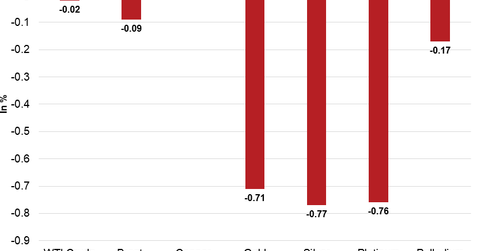

At 4:00 AM EST on January 26, the West Texas Intermediate crude oil futures for March 2018 delivery were trading at $65.44 per barrel—a drop of 0.11%. The Brent crude oil futures for March 2018 delivery fell 0.17% to $70.30 per barrel. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) closed at $38.91 after declining 2.0% on January 25.

Copper

Following a weak performance for two weeks, copper started this week on a stronger note and traded with mixed sentiment throughout the day. The upbeat economic growth outlook along with supporting demand trends from China helped copper prices. In the early hours on January 26, copper is trading with strength above opening prices due to support from the weaker dollar. The SPDR S&P Metals and Mining ETF (XME) fell 1.2% and closed at $38.62 on Thursday.

Gold (GLD) and silver (SLW) are weak in the early hours on Friday. The prices lost strength on Thursday after President Trump commented that he expects the dollar to get stronger. Strength in the dollar weighs on the prices of dollar-denominated commodities like copper, gold, and silver. Platinum and palladium are also weak in the early hours on January 26.