Nucor: What Analysts Expect This Earnings Season

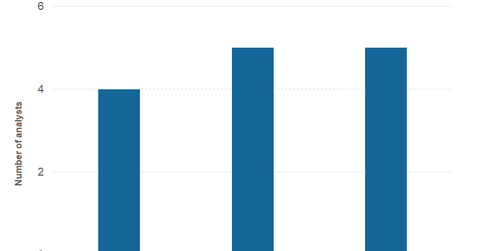

Nucor received a “strong buy” rating from four analysts, while five analysts have a “buy” rating on the stock and five analysts have a “hold” rating.

Jan. 18 2018, Updated 2:55 p.m. ET

Earnings season

Nucor (NUE) is expected to release its 4Q17 earnings on January 30. AK Steel (AKS) will release its 4Q17 earnings on the same day. U.S. Steel Corporation’s (X) earnings will be released on January 31. In this part, we’ll see how analysts rate Nucor this earnings season.

Analysts’ rating

Nucor has received a “strong buy” rating from four analysts, while five analysts have a “buy” rating on the stock. The remaining five analysts rated Nucor as a “hold” or some equivalent. According to the estimates compiled by Thomson Reuters, Nucor carries a mean consensus target price of $70.3. Based on the closing prices on January 17, it represents a potential upside of 1.5%.

Some of the analysts raised Nucor’s target price this month amid improved steel market sentiments (MT) (XME). Earlier this month, Cowen and Company raised Nucor’s target price from $63 to $70. Morgan Stanley also raised Nucor’s target price from $60 to $70 on January 10. On January 16, Deutsche Bank raised Nucor’s target price from $70 to $75.

4Q17 earnings

Analysts polled by Thomson Reuters expect Nucor to post revenues of $4.83 billion in 4Q17—compared to $5.17 billion in 3Q17 and $3.95 billion in 4Q16. Nucor is expected to post an EPS (earnings per share) of $0.58 in 4Q17. To put this in context, Nucor posted an EPS of $0.79 in 3Q17 and $0.50 in 4Q16. Looking at Nucor’s guidance, it expects to post an EPS between $0.50 to $0.55 in 4Q17. While releasing its 4Q17 guidance, Nucor noted that “projected fourth quarter of 2017 results do not contain any estimates related to the impact of the proposed federal tax legislation in the United States.”

Next, we’ll see how analysts rate AK Steel before its 4Q17 earnings.