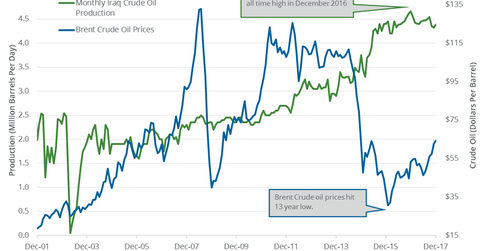

Iraq’s Crude Oil Production Capacity Could Hit 5 MMbpd

The EIA estimated that Iraq’s crude oil production increased by 60,000 bpd to 4,380,000 bpd in December 2017—compared to the previous month.

Jan. 17 2018, Updated 11:30 a.m. ET

Iraq’s crude oil production

The EIA estimated that Iraq’s crude oil production increased by 60,000 bpd (barrels per day) to 4,380,000 bpd in December 2017—compared to the previous month. However, production fell by 280,000 bpd or 6% from a year ago. The year-over-year decline in production is due to ongoing production cuts.

Iraq is OPEC’s second-largest crude oil producer. Any decline in Iraq’s oil production has a positive impact on oil (BNO) (DBO) prices. It also benefits energy producers’ (XOP) (IXC) earnings like BP (BP), Chevron (CVX), Shell (RDS.A), Stone Energy (SGY), and Whiting Petroleum (WLL).

Iraq’s oil output capacity and production cuts

On January 13, 2018, Iraq’s oil minister said that the country’s oil output capacity was nearing 5,000,000 bpd. However, Iraq will abide by the ongoing production cut pact. Iraq pledged to cut production by 210,000 bpd as part of the production cut deal. Higher compliance with production cuts is bullish for oil prices. Higher oil prices favor ETFs like the iShares Global Energy ETF (IXC) and the First Trust Energy AlphaDEX Fund (FXN).

Iraq’s crude oil exports

Iraq exported 3,400,000 bpd of crude oil from the southern ports in the country in December 2017. The exports were at 3,500,000 bpd in November 2017, according to Bloomberg. Any fall in crude oil exports is bullish for oil (USO) (DTO) prices.

Impact

Iraq targets to increase its crude oil production to 5,000,000 bpd. Any increase in crude oil production and exports is bearish for oil (UCO) (SCO) prices. Higher compliance with the production cut deal and any supply outage will be bullish for oil.

Next, we’ll discuss some crude oil price forecasts.