Halliburton’s 1-Week Returns on December 29

Halliburton’s (HAL) one-week stock price was 1.8% higher until December 29, 2017. Since December 22, the Energy Select Sector SPDR ETF (XLE) has risen 0.4%.

Jan. 3 2018, Published 9:48 a.m. ET

Halliburton’s stock price compared to the industry

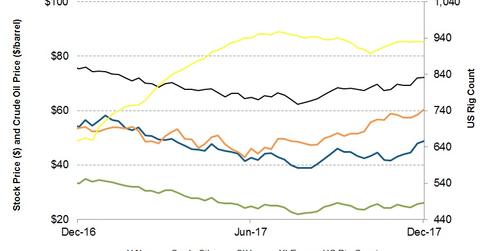

Halliburton’s (HAL) one-week stock price was 1.8% higher until December 29, 2017. Since December 22, 2017, the Energy Select Sector SPDR ETF (XLE) has risen 0.4%. XLE represents the broader energy industry ETF. The VanEck Vectors Oil Services ETF (OIH) saw 1.3% one-week returns. So, Halliburton has outperformed XLE and OIH in the past week. The returns from the Dow Jones Industrial Average (DJIA-INDEX) were marginally negative in the past week until December 29, 2017. Since December 22, 2017, the SPDR S&P 500 ETF (SPY) has underperformed Halliburton. SPY has produced -0.2% returns during this period.

Crude oil price and rigs

On December 29, 2017, the West Texas Intermediate crude oil price was 3% higher than a week ago. Despite crude oil price’s strength, the US rig count fell by two in the past week until December 29, 2017. To learn more about crude oil price’s recent drivers, read Traders Tracking Key Drivers of Crude Oil Futures in 2018. To learn about the oilfield services companies with the top returns, read Top 5 OFS Companies Based on 2017 Returns.

Halliburton’s outlook in 4Q17

- Halliburton’s D&E (drilling and evaluation) division’s revenue might increase by low-single digits in international operations.

- In the C&P (completion and production) division, international revenue might increase by low-single digits.

- In the D&E division, North American revenue might change in line with the average land rig count.

- In the C&P division, North American revenue might outperform the average change in the US land rig count.

In this series

In this series, we’ll look at the short interest in Halliburton and its correlation with crude oil. Next, we’ll discuss Halliburton’s stock price forecast.