Why Analysts Project Lower Net Debt for Cliffs in 2017

Although investors are still concerned about Cleveland-Cliffs’ (CLF) debt, it has come a long way with respect to debt levels.

Jan. 18 2018, Updated 10:30 a.m. ET

Financial leverage

Although investors are still concerned about Cleveland-Cliffs’ (CLF) debt, it has come a long way with respect to debt levels. With new management in 2014 and a focus on debt reduction as the utmost priority, investors’ concerns have been allayed somewhat.

The company had $1.7 billion in total debt and $1.4 billion in net debt at the end of 3Q17, a decline of $500 million and $600 million, respectively, compared to 3Q16.

Liquidity position is comfortable

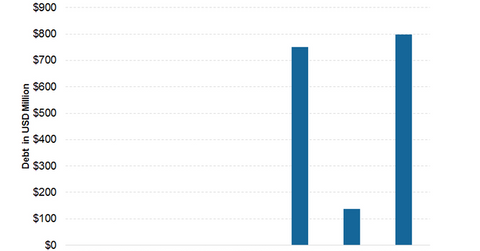

Cleveland-Cliffs (CLF) has taken care of the maturity wall that was looming. At the beginning of 2017, it had three layers of high-coupon secured debt with a maturity wall of $1.7 billion in 2020. Cliffs reduced this wall by $1.5 billion in the first nine months of the year. Most of this debt has either been retired or pushed back an additional five years with lower interest rates.

As per the consensus estimates compiled by Thomson Reuters, Cliffs’ net debt is expected to decline by 26% in 2017 as compared to 2016.

Net-debt-to-forward-EBITDA ratio

A company’s net-debt-to-forward-EBITDA ratio reflects the number of years it would take to completely pay off its debt only from its EBITDA.

Cleveland-Cliffs has made an improvement on both fronts. Its EBITDA has improved, while debt has reduced, which has significantly improved its net-debt-to-forward-EBITDA ratio. As per the analyst consensus, its ratio should improve to 2.75x at the end of 2017 as compared to 5.20x at the end of 2016. Investors should note that CLF has come a long way in reducing its financial leverage. Its net-debt-to-forward-EBITDA ratio was 9.0x at the end of 2015.

Other US (VTI) (DOW) steel companies (SLX) with high financial leverage like ArcelorMittal (MT), AK Steel (AKS), and U.S. Steel (X) have also made successful efforts to reduce their debt levels.