Will US Crude Oil Futures Be Range Bound This Week?

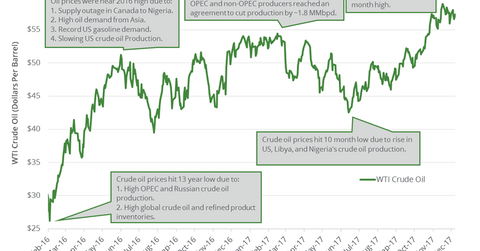

WTI crude oil (USO) futures hit $58.95 per barrel on November 24, 2017—the highest level in nearly three years.

Nov. 20 2020, Updated 5:05 p.m. ET

Energy calendar

The American Petroleum Institute will release its crude oil inventory report on December 19, 2017. The EIA will publish its weekly crude oil inventory report on December 20, 2017. Baker Hughes, a GE company, will release its US oil rig report on December 22, 2017.

All of these events could influence oil (UCO) prices this week. US oil (DBO) prices fell 0.1% last week due to bearish drivers. We discussed the drivers in Part 1 of this series. Lower oil (UWT) prices are bearish for oil producers (FXN) (XLE) like Goodrich Petroleum (GDP) and Stone Energy (SGY).

Bullish drivers for WTI crude oil futures

WTI crude oil (USO) futures hit $58.95 per barrel on November 24, 2017—the highest level in nearly three years. Prices rose due to the production cut extension, lower global crude oil inventories, and the supply outage in Libya, Nigeria, Venezuela, and Iraq.

Any fall in US and Cushing oil inventories and higher compliance with production cuts could help oil (SCO) prices. A possible strike in Nigeria could also benefit oil prices.

Bearish drivers for WTI crude oil prices

WTI oil (DWT) futures hit $26.21 per barrel on February 11, 2017—the lowest level in more than 13 years. Any increase in US crude oil production and a strong dollar (UUP) could cap the upside for oil prices this week.

Crude Oil Volatility Index

The CBOE Crude Oil Volatility Index (OVX) fell 7.6% to 21.3 on December 15, 2017—near a three-year low. It suggests less volatility in oil (USO) prices. US crude oil prices closed above $57 per barrel seven times in the last ten trading sessions. It suggests that prices could trade around these levels unless there’s a real catalyst.

January US crude oil futures contracts were above their 50-day and 100-day moving averages on December 15, 2017. It suggests that prices could trade higher.

Read Will US Natural Gas Futures Fall More? and Gasoline Inventories and Crude Oil Production Impact Oil Prices for the latest updates on natural gas and oil.