Will Crude Oil Futures Be Range Bound or Trend Higher?

US crude oil (DWT) futures hit $58.95 per barrel on November 24, 2017, which was the highest level in the last 30 months.

Nov. 20 2020, Updated 11:36 a.m. ET

Energy calendar

The American Petroleum Institute will release its crude oil inventory report on December 12, 2017. The U.S. Energy Information Administration will publish its weekly petroleum status report on December 13, 2017. Baker Hughes, a GE company, will release its US oil rig report on December 15, 2017.

All of these events could drive oil (OIL) prices this week. US oil (DTO) prices fell 1.7% last week. Lower oil (USO) prices have a negative impact on oil producers (FENY) (IXC) like Bill Barrett (BBG) and Denbury Resources (DNR).

Bullish catalyst for crude oil futures

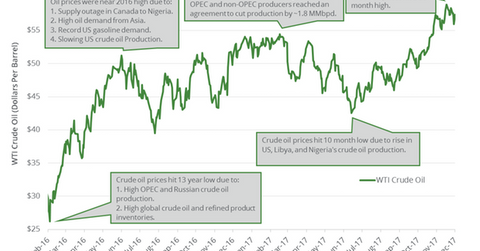

US crude oil (DWT) futures hit $58.95 per barrel on November 24, 2017, which was the highest level in the last 30 months. Prices rose due to the production cut extension, lower OECD, US, and Cushing crude oil inventories, and the oil supply outage in Nigeria, Libya, Venezuela, and Iraq.

Any fall in US and Cushing oil inventories, higher compliance with output cuts, and lower OPEC exports could boost oil (UWT) prices. A possible strike in Nigeria could also support oil prices.

Bearish catalyst for crude oil prices

US oil (USL) futures hit $26.21 per barrel on February 11, 2017. It was the lowest level in more than 13 years. Any increase in US oil rigs and the output could weigh on crude oil futures this week. The Fed could drive the US dollar (UUP) and pressure oil prices this week.

Crude Oil Volatility Index

The CBOE Crude Oil Volatility Index (OVX) rose 3.1% to 23.8 on December 8, 2017. However, it was near a three-year low. It indicates that traders are expecting less volatility in oil (UWT) prices. However, January US crude oil futures contracts were above their 20-day, 50-day, and 100-day moving averages on December 8, 2017. It indicates that prices could trade higher.

Read US Natural Gas Futures Could Maintain Bearish Momentum and Is It the Beginning of More Problems for Crude Oil Bulls? for the latest updates on natural gas and oil.