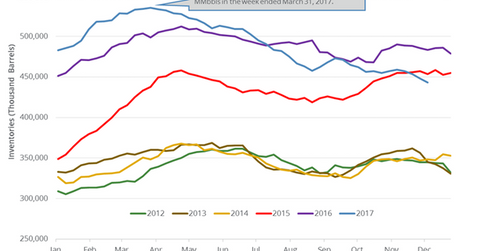

US Crude Oil Inventories Have Fallen 8.3% in 2017

US crude oil inventories fell by 5.1 MMbbls (million barrels) to 442.9 MMbbls on December 1–8, 2017, according to the EIA.

Dec. 14 2017, Updated 12:58 p.m. ET

Crude oil futures

January WTI crude oil futures (DWT) (USL) contracts trading in NYMEX rose 0.1% to $56.68 per barrel at 1:13 AM EST on December 14, 2017. Prices are near a one-week low. The iPath S&P GSCI Crude Oil TR ETN (OIL) fell 1.4% to 6.03 on December 12, 2017. The ETF tracks the performance of crude oil futures.

The E-mini S&P 500 (SPY) futures contracts for March delivery fell 0.02% to 2,668.5 at 1:13 AM on December 14, 2017.

US crude oil inventories

The EIA released its weekly petroleum status report on December 13, 2017. US crude oil inventories fell by 5.1 MMbbls (million barrels) to 442.9 MMbbls on December 1–8, 2017, according to the EIA. Inventories fell 1.1% week-over-week and by 40 MMbbls or 8.3% MMbbls year-over-year. They fell for the fourth straight week.

Earlier, the market survey estimated that US crude oil inventories would have fallen by 2.9 MMbbls on December 1–8, 2017. US crude oil (UWT) prices fell on December 13, 2017, despite the larger-than-expected fall in US oil inventories. In Part 1 of this series, we discussed oil prices’ bearish drivers.

WTI oil (DWT) prices have fallen nearly 4% since the highs on November 24, 2017. Lower oil (USO) prices have a negative impact on energy producers (PXI) (VDE) like Newfield Exploration (NFX), Hess (HES), and Goodrich Petroleum (GDP).

Impact

US crude oil inventories fell by 92.6 MMbbls or 17.3% from their peak. So far, they have fallen 8.3% in 2017, which is positive for oil (DBO) prices. However, US crude oil inventories are ~48 MMbbls or 12.1% above their five-year average for the week ending December 8, 2017. It’s bearish for oil prices. If the difference drops, it’s a bullish sign for oil prices.

Next, we’ll discuss US crude oil production.