How Tyson Foods Compares with Its Peers in Valuation

As of December 22, 2017, Tyson Foods (TSN) stock was trading at a 12-month forward PE (price-to-earnings) multiple of 13.9x, which could seem attractive to investors.

Dec. 29 2017, Updated 9:02 a.m. ET

Valuation summary

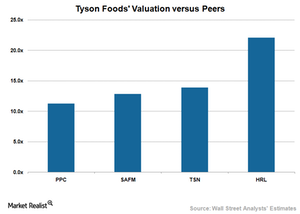

As of December 22, 2017, Tyson Foods (TSN) stock was trading at a 12-month forward PE (price-to-earnings) multiple of 13.9x. That could seem attractive to investors, given the company’s healthy earnings growth rate projection. Tyson is currently trading well below the S&P 500 Index’s (SPX-INDEX) forward PE valuation multiple of 19.2x and the Consumer Staples Select Sector SPDR ETF’s (XLP) forward PE ratio of 21.4x.

Peer comparison

Tyson Foods’ current valuation multiple remains slightly higher than Pilgrim’s Pride’s (PPC) and Sanderson Farms’ (SAFM) forward PE multiples of 11.2x and 12.8x, respectively. However, Tyson Foods is expected to generate strong earnings growth compared to its peers in the coming years, driven by sales leverage and cost-savings.

Tyson Foods’ long-term earnings growth is close to 10%, which is higher than most of its peers. In comparison, Pilgrim’s Pride’s (PPC) and Sanderson Farms’ (SAFM) long-term growth rates are both expected to be 5%. Hormel Foods (HRL), which trades at a valuation multiple of 22.1x, is expected to generate long-term earnings growth of 9%.

The 12-month forward PE multiple differs among peers based on several factors, including earnings growth expectations and leverage.

Tyson Foods’ earnings are expected to rise on a YoY (year-over-year) basis, driven by higher volumes, increased average selling prices, and lower feed costs. Supply-chain productivity and savings from efficient procurement and lower overhead costs could further support its profitability growth.