Today’s Correlation Study of Key Mining Stocks with Gold

The Global X Silver Miners ETF (SIL) and the Sprott Gold Miners (SGDM) have fallen 3.5% and 4.4%, respectively, on a 30-day trailing basis.

Dec. 13 2017, Published 11:58 a.m. ET

Correlation analysis

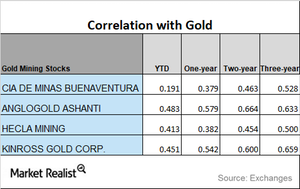

When the investors consider parking their money in mining stocks, it’s important for them to consider the stocks’ correlations with gold. Gold is the primary precious metal, and mining stocks tend to see price changes based on what happens with gold.

A study of the correlation of mining shares to gold is crucial since it gives investors clues about the directional move of precious metal miners. In this part of our series, we’ll be assessing four key mining stocks for this analysis: Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD).

Among these four mining stocks, B2Gold has seen the least correlation with gold on a YTD (year-to-date) basis, while Royal Gold has seen the highest correlation with gold YTD.

Most mining funds are also closely associated with gold as well as with the other three precious metals. The Global X Silver Miners ETF (SIL) and the Sprott Gold Miners (SGDM) have fallen 3.5% and 4.4%, respectively, on a 30-day trailing basis.

Correlation analysis

Among these four mining stocks, only Alamos has seen a mixed reaction to gold over the past three years. AG, BTG, and RGLD have seen their correlations with gold fall over the past three years. Royal Gold’s three-year correlation with gold is now 0.58, but it’s lower at 0.49 on a one-year basis.

This correlation of 0.49 suggests that Royal Gold has moved in the same direction as gold about 0.49% of the time over the past one year. Notably, it’s common to see the correlations of mining stocks with gold change significantly over time.