Rising Price Pressures: A Sign of Relief for the Bond Markets?

The increase in price pressure, although reassuring for the Fed, might not lead to a higher rate of inflation in the short term.

Dec. 4 2017, Published 11:28 a.m. ET

November Fed Beige Book: Price pressures on the rise

According to the latest edition of the Fed’s Beige Book, which was released on November 29, 2017, price pressures have increased in the observation period between October and mid-November. Most of the 12 Fed districts have reported a moderate increase in non-labor input costs and selling prices. Prices in the construction industry were reported to have increased the most in the observation period, mostly due to an increased demand from rebuilding efforts in the hurricane-impacted regions. The spillover effect of this increased demand was also seen in the transportation (IYT) and manufacturing sectors. The Fed districts have reported an increase in oil and natural gas (EMLP) and a mixed price report for the agricultural sector.

Will increased price pressure improve inflation outlook?

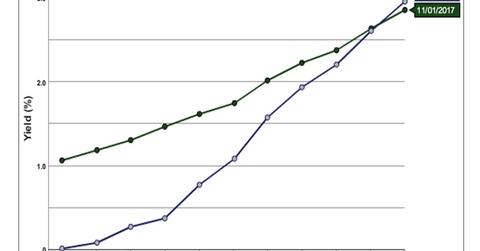

An increase in price pressures could lead to a higher rate of inflation if the price rises are passed on to consumers. The November Beige Book indicated that the price rises in transportation and manufacturing were largely passed on to consumers. If this trend of increasing input costs and wages continues, inflation (TIP) could pick up in the future. The process could take more than a few months, and inflation (VTIP) could still be below the Fed’s 2% inflation (SCHP) target rate. The Fed, in its previous statements, clearly stated that the 2% inflation target could only be achieved in 2019.

Outlook for the December meeting

The increase in price pressure, although reassuring for the Fed, might not lead to a higher rate of inflation in the short term. The flow-through of higher costs to consumers happens over a period of time. The Fed has already communicated its intentions to increase the interest rate at the December meeting, and nothing in the Beige Book is likely to change that decision. There could be dissension from one or two FOMC (Federal Open Market Committee) members, but the rate hike could still go through. The hope is that investors’ expectations for inflation (CPI) could increase based on these price increases and result in stopping the yield curve from flattening further.