Production Cut Extension Could Influence US Natural Gas Rigs

Baker Hughes, a GE company, is scheduled to release its US crude oil and natural gas rig count report on December 1, 2017.

Dec. 1 2017, Updated 9:45 a.m. ET

US natural gas rigs

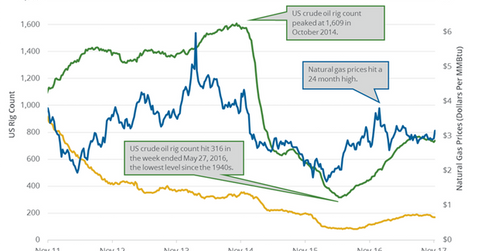

Baker Hughes, a GE company, is scheduled to release its US crude oil and natural gas rig count report on December 1, 2017. In the previous week’s report, gas rigs fell by one to 176 on November 17–22, 2017. However, the US natural gas rig count was near a six-week high. The rigs rose due to higher oil (UWT) (USO) and gas (UNG) (GASL) prices in the last few weeks.

Natural gas rigs have risen by 95 or 118% since the lows in August 2016. Similarly, oil (DWT) (UCO) and gas (UGAZ) (DGAZ) prices have risen ~120% and ~80% from their lows in early 2016.

Higher oil and gas prices benefit oil and gas producers (IYE) (FXN) and drillers like EOG Resources (EOG), Southwestern Energy (SWN), Rowan Companies (RDC), and Gulfport Energy (GPOR).

OPEC’s meeting

On November 30, 2017, OPEC and Russia agreed to extend the ongoing production cuts until December 2018. However, they signaled that there could be an early exit depending on oil market conditions. Oil (BNO) (DBO) prices have risen 30% since June 2017 due to expectations of prolonging the production cuts. The production cuts would tighten global supplies and support oil prices in 2018.

Crude oil prices impact on rigs and gas prices

US gas rigs were near six-week high, as we discussed above. US crude oil prices are near a three-year high. Natural gas is usually an associated product of crude oil. Higher oil prices would increase US crude oil and natural gas rigs and production. It would increase natural gas supplies, which is bearish for natural gas prices.

Next, we’ll cover natural gas price forecasts and drivers.