Unexpected Build in US Crude Oil Inventories Pressures Oil Futures

The EIA (or US Energy Information Administration) released its Weekly Petroleum Status Report on November 8, 2017.

Nov. 9 2017, Published 8:35 a.m. ET

US crude oil inventories

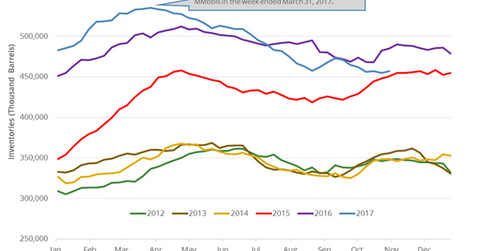

The EIA (or US Energy Information Administration) released its Weekly Petroleum Status Report on November 8, 2017. It reported that US crude oil inventories rose by 2,237,000 barrels, or 0.5%, to 457.1 MMbbls (million barrels) between October 27, 2017, and November 3, 2017. Inventories fell by 27.9 MMbbls, or 5.7%, during the same period in 2016.

A Reuters poll had earlier estimated that US crude oil inventories would fall 2,900,000 barrels between October 27, 2017, and November 3, 2017. Crude oil (USL) (UCO) (SCO) prices fell on November 8, 2017, due to the surprise build in US oil inventories.

However, US crude oil (UWT) (DWT) prices are near a 30-month high. They are up ~30% since the lows in June 2017 due to several bullish drivers covered in part one of this series. Oil and gas exploration and production companies (FENY) (IEO) (XES) like Pioneer Natural Resources (PXD), SM Energy (SM), Anadarko Petroleum (APC), and Marathon Oil (MRO) benefit from higher oil prices.

US refinery crude oil demand and imports

US refinery crude oil demand rose by 290,000 bpd (barrels per day) to 16,305,000 bpd between October 27, 2017, and November 3, 2017. Refinery demand rose 1.8% week-over-week and 488,000 bpd, or 3.1%, year-over-year.

US crude oil imports rose by 194,000 bpd to 7,377,000 bpd between October 27, 2017, and November 3, 2017. The imports rose 2.6% week-over-week but fell 65,000 bpd or 0.8% year-over-year.

Impact of US crude oil inventories

The nationwide crude oil inventories are 15%, or 59.4 MMbbls, above their five-year average for the week ending November 3, 2017, which could pressure oil (BNO) (SCO) prices. However, crude oil inventories are down ~14.5% from their peak in March 2017, which is bullish for oil (DTO) (OIL) prices.

Next, we’ll discuss how record US crude oil production affects oil prices.