How Strong Is DowDuPont’s Interest Coverage?

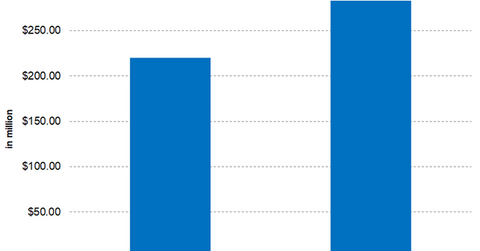

In 3Q17, DWDP’s interest expense was reported at $283 million as compared to the $220 million in 3Q16 on a proforma basis.

Nov. 22 2017, Updated 10:33 a.m. ET

DowDuPont’s interest expense

In the previous part, we saw that DowDuPont (DWDP) has one of the lowest debt-to-equity ratios among its peers. In this part, we’ll analyze DWDP’s interest coverage ability. In 3Q17, DWDP’s interest expense was reported at $283 million as compared to the $220 million in 3Q16 on a proforma basis. The interest expense includes amortization of debt discount as well. The increase in DWDP’s interest expense was primarily due to the merger and the long-term debt assumed from the DCC transaction.

Going forward, the interest expense might come down assuming that the company doesn’t borrow any more. DWDP has some notes with higher coupon rates that are due to mature within the next two years. Once they are paid, the interest expense is expected to come down. In the next five years, DWDP has to pay back approximately $20 billion. However, at the end of 3Q17, DWDP had cash and cash equivalents of $13.2 billion. With strong free cash flow generation, the cash position is expected to get stronger. It remains to be seen if DWDP will pay these debts from its cash or if it will raise new debt.

DWDP’s interest coverage ratio

The interest coverage ratio indicates how well a company can service its debt. This can be determined by dividing EBIT (earnings before interest and taxes) by interest expense. A higher ratio indicates ease in servicing its debt.

The company’s 3Q17 filings indicate DWDP’s interest coverage ratio stood at 5.0x, which suggests that DWDP can easily service its debt. However, a higher multiple than the present one would boost investor confidence. DWDP’s peers Westlake Chemical (WLK), Eastman Chemical (EMN), and LyondellBasell (LYB) have interest coverage ratios of 9.30x, 6.70x, and 13.70x, respectively, higher than DWDP.

Investors who want exposure to DWDP can invest in the Vanguard Materials ETF (VAW), which holds 18.4% of its portfolio in DowDuPont as of November 21, 2017.