Natural Gas Futures Spread: Analyzing Oversupply Concerns

On November 15, 2017, natural gas (UNG) (BOIL) December 2017 futures traded at a discount of ~$0.1 to December 2018 futures.

Nov. 20 2017, Updated 7:32 a.m. ET

Futures spread

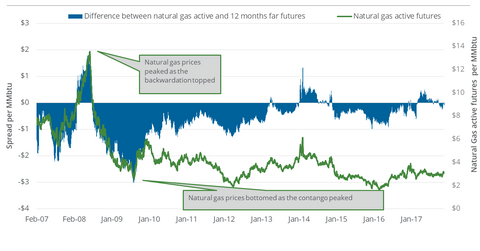

On November 15, 2017, natural gas (UNG) (BOIL) December 2017 futures traded at a discount of ~$0.1 to December 2018 futures. The difference between the two futures contracts is the “futures spread.” So, the futures spread was at a discount on November 15. On November 8, 2017, the future spread was at a discount of $0.02. On November 8–15, 2017, natural gas futures fell 3%.

Discount and premium

When the futures spread is at a discount or the discount expands, natural gas prices might fall. On March 3, 2016, natural gas futures settled at their 17-year low. On the same day, the discount was at $0.84. In contrast, a contraction in the discount might help natural gas prices rise.

On the other side, if the futures spread is at a premium or the premium expands, natural gas prices might rise. On May 12, 2017, natural gas futures settled at the highest closing price in 2017. On the same day, the premium was at $0.5. A contraction in the premium could make natural gas prices fall.

Latest futures spread

In the seven calendar days to November 15, 2017, the discount expanded and natural gas prices fell. So, oversupply concerns could shape natural gas prices. In Part 2 of this series, we discussed how the rise in the oil rig count could impact natural gas supplies.

Energy sector

US natural gas producers’ (XOP) (DRIP) (IEO) output price hedging operations could depend on the natural gas futures forward curve. The forward curve also influences midstream natural gas transportation, storage, and processing companies (AMLP).

On November 15, 2017, natural gas January 2018 futures settled ~$0.1 above the December 2017 futures. With this type of a price difference, ETFs that provide exposure to natural gas prices like the ProShares Ultra Bloomberg Natural Gas (BOIL) and the United States Natural Gas Fund LP (UNG) might return less than natural gas futures because of the negative rollover cost. On November 15, 2017, the prices of natural gas futures contracts for delivery until February 2018 settled at progressively higher levels.