MLPs Were Sluggish despite Strong Crude Oil Last Week

Despite strong crude oil, MLPs’ sluggishness continued last week. The Alerian MLP Index (^AMZ) saw a new 52-week low of $256.7 last week.

Nov. 28 2017, Published 10:44 a.m. ET

AMZ fell 0.6% last week

US crude oil was strong last week. It rose 4.2% during the week and ended at $58.95 per barrel. Last week’s gain in crude oil could be attributed to a fall in the crude oil inventory and expectation of supply cuts. For a recent update and outlook on crude oil prices, read What to Expect from US Crude Oil Next Week.

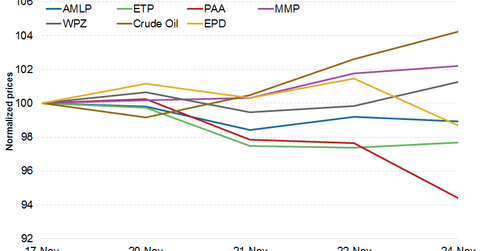

Despite strong crude oil, MLPs’ sluggishness continued last week. The Alerian MLP Index (^AMZ) saw a new 52-week low of $256.7 last week. Overall, the index fell 0.6% during the week and ended at $258.6. Thirty out of 93 MLP were trading close (at a difference less than 5%) to their 52-week lows by the end of last week.

Out of the total 93 MLPs, 52 ended in the red, 39 ended in the green, and the other two ended the week flat. Among the top MLPs, Plains All American Pipelines (PAA), Energy Transfer Partners (ETP), and Enterprise Products Partners (EPD) fell 5.6%, 2.3%, and 1.2%, respectively, while Williams Partners (WPZ) rose 1.3%. In this series, we’ll discuss the performance drivers for the top MLP losers and gainers.

The Alerian MLP ETF (AMLP) also saw a new 52-week low of $10.1. It ended the week 1.1% lower. AMLP underperformed the Energy Select Sector SPDR Fund (XLE) and the SPDR S&P 500 ETF (SPY)(SPX-INDEX) last week. XLE and SPY rose 0.7% and 0.9%.

Last week, MLPs’ weakness could be due to weakness in natural gas prices and the drilling activity in some of the regions despite strong crude oil prices. It includes the Eagle Ford region.

Fund flows

The Alerian MLP ETF saw a net inflow of $12.8 million funds last week despite the recent weakness. On the other hand, the JP Morgan Alerian MLP Index ETN (AMJ) saw a net inflow of $21.9 million funds last week.