How Analysts View Freeport after Its 3Q17 Earnings Beat

Freeport-McMoRan released its 3Q17 earnings on October 25, posting revenues of ~$4.3 billion in 3Q17, compared with ~$3.7 billion in 2Q17.

Nov. 20 2020, Updated 1:23 p.m. ET

3Q17 earnings beat

Freeport-McMoRan (FCX) released its 3Q17 earnings on October 25, posting revenues of ~$4.3 billion in 3Q17, compared with ~$3.7 billion in 2Q17 and ~$3.9 billion in 3Q16. Freeport reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.61 billion in 3Q17, compared with $1.17 billion in 2Q17.

Higher copper prices (RIO) (DBC) were a key driver of Freeport’s 3Q17 earnings. Freeport managed to beat the consensus earnings estimates for both its top line and bottom line.

You can read Why Markets Gave Freeport’s 3Q17 Earnings Beat a Miss for a broad overview of Freeport’s 3Q17 earnings.

Price target

According to the consensus estimates compiled by Thomson Reuters, Freeport has a mean one-year price target of $16.17, which represents 10.4% upside over its closing price on November 6. By contrast, the stock carried a one-year target price of $15.56 on October 24—one day before its earnings release.

Some analysts have revised their ratings of Freeport after its 3Q17 earnings release. On October 26, RBC raised Freeport’s price target from $14 to $16, though the next day, Berenberg lowered its price target from $12.30 to $12.15. On October 30, UBS raised Freeport’s target price from $13.5 to $14.

Analyst recommendations

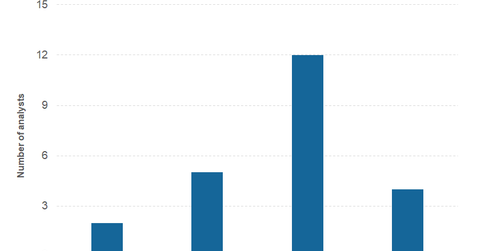

Given its consolidated ratings, analysts now have a consensus “hold” recommendation for Freeport stock amid its negotiations with the Indonesian government. Specifically, 52% of the analyst polled by Thomson Reuters on November 6 have rated Freeport as a “hold” or some equivalent, while 30% have a “buy” or higher rating, and the remaining analysts have issued a “sell.”

By comparison, Southern Copper (SCCO) has been rated a “sell” or lower by 42% of analysts.

In the next part, we’ll see how analysts are rating Glencore (GLEN-L).