Comparing Miners’ Correlation with Gold

Correlation analysis Mining stocks’ performance usually depends on precious metal prices. Correlation analysis can give investors some perspective on how mining stocks relate to precious metals, especially gold. In this part of our series, we’ll look at four miners—Royal Gold (RGLD), Goldcorp (GG), Franco-Nevada (FNV), and Randgold Resources (GOLD)—and their correlation with gold. On Monday, the ETFS Physical […]

Nov. 23 2017, Updated 7:34 a.m. ET

Correlation analysis

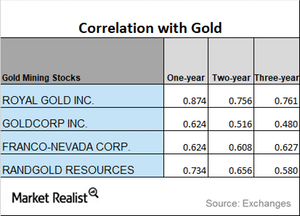

Mining stocks’ performance usually depends on precious metal prices. Correlation analysis can give investors some perspective on how mining stocks relate to precious metals, especially gold. In this part of our series, we’ll look at four miners—Royal Gold (RGLD), Goldcorp (GG), Franco-Nevada (FNV), and Randgold Resources (GOLD)—and their correlation with gold.

On Monday, the ETFS Physical Silver Shares ETF (SIVR) and the ETFS Physical Swiss Gold Shares ETF (SGOL) fell 2% and 0.82%, respectively.

Trends

Among the four miners we’re examining, Goldcorp and Franco-Nevada have had the lowest correlation with gold during the past year, while Royal Gold has had the highest. Randgold and Goldcorp have seen an uptrend in correlation over the past three years, while the other two miners’ correlation has been mixed.

Randgold has a three-year correlation of 0.58 with gold and a one-year correlation of 0.73, which suggests Randgold has moved in the same direction as gold ~73% of the time over the past year.