Can Union Pacific’s Free Cash Flows Support Its Higher Dividend?

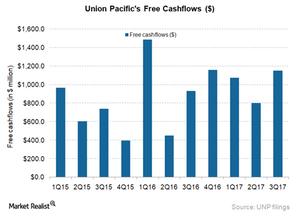

Union Pacific had FCF of $3.02 billion in the first nine months of 2017, compared with $2.86 billion in the corresponding period of 2016.

Dec. 4 2020, Updated 10:53 a.m. ET

UNP’s operating cash flows

A company’s FCF (free cash flow) determines the extent of its dividends, among other things. FCF is the excess of OCF (operating cash flow) over a company’s capital expenditure or capex.

If a company’s OCF is high and its capex is low, FCF will be higher, and so Union Pacific (UNP) investors have to consider OCF levels and as well as the extent of its capex.

In the first nine months of 2017, Union Pacific’s capex-to-revenue ratio was ~15%—the lowest among all class-I railroads. In fact, UNP’s capex has been on the lower side for the past three years.

UNP’s OCF was ~$6.2 billion in 2012 but rose steadily by $1.3 billion to ~$7.5 billion in 2016. Its OCF was $5.4 billion in the first nine months of 2017, compared with $5.2 billion during the same period of 2016.

UNP’s FCF

Union Pacific had FCF of $3.02 billion in the first nine months of 2017, compared with $2.86 billion in the corresponding period of 2016. A deep dive in UNP’s cash flow statement reveals that its FCF grew from $2.14 billion in 2012 to $4.0 billion in 2016. This translates to a ~95% rise in the past five years (ended 2016).

Given UNP’s expected annual cash dividend of ~$2.1 billion, its FCF appears to be sufficient for a higher dividend payment. Although its FCF supports its dividends, this may not be the case with other class-I railroads.

Peer group FCF levels

Recently, Calgary-based Canadian Pacific Railway declared a 4Q17 cash dividend of $0.5625 Canadian dollars per share. Given the high level of CP’s FCF, it appears to have sufficient FCF to support the dividend payment.

Kansas City Southern (KSU) also appears to have sufficient FCF for its dividend payments. Among Eastern US railroads, Norfolk Southern (NSC) appears to have sufficient FCF for its dividends, but arch-rival CSX’s (CSX) FCF is much lower, given its current level of dividend payments (XTN).

In the past few years, most of the class-I railroads have bought back stock by raising debt. But usually, in prudent practice, shares aren’t repurchased by raising debt because the interest payment on the debt defeats the purpose of returning value through the stock buyback.

In the next and final part of this series, we’ll go through Union Pacific’s recent returns.