October Update: What Analysts Think about FMC

FMC (FMC) stock has risen 6.0% over the past month. The stock has significantly outperformed the benchmarks (SPY) (MOO) YTD with a 68.0% rise.

Oct. 19 2017, Updated 9:10 a.m. ET

FMC stock

FMC (FMC) stock has risen 6.0% over the past month. The stock has significantly outperformed the benchmarks (SPY) (MOO) YTD (year-to-date) with a 68.0% rise. Compare that to Monsanto (MON), which has risen 16.0% YTD. Compass Minerals International (CMP) has fallen 16.0% so far this year.

FMC is expected to announce its earnings on November 6, 2017.

Analyst ratings

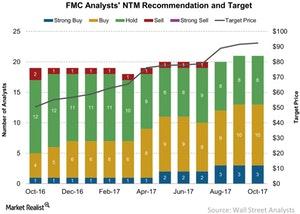

In October 2017, 21 analysts are covering FMC. Looking at the above chart, we see that there are two fewer analysts covering the stock than last year. Three analysts have given it a “strong buy,” which is the same as last month. Ten analysts have given it a “buy” recommendation, which is also the same as last month.

Unlike PotashCorp (POT), Mosaic (MOS), and CF Industries (CF), FMC has a “buy” recommendation from most of the analysts.

Target price

The current consensus price target for FMC is $93.30 as of October 16, 2017. That’s 2.6% higher than $90.90 in September. FMC closed 1.8% higher on October 16 at $95.

In the next part, we’ll look at analysts’ ratings and the price target for Sociedad Química y Minera de Chile (SQM).