Understanding Phillips 66’s Cash Flow

In 1H17, Phillips 66 saw its cash from operations fall 7% YoY to ~$1.3 billion. This was due to negative cash flow in 1Q17, led by seasonal inventory build-up.

Sep. 18 2017, Updated 7:36 a.m. ET

Phillips 66’s cash flow

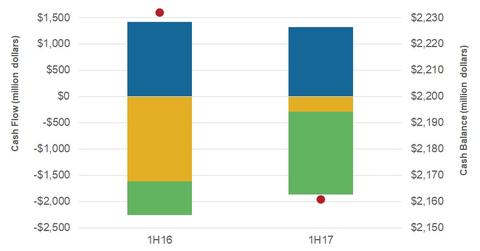

In 1H17, Phillips 66 (PSX) saw its cash from operations fall 7% YoY to ~$1.3 billion. This was due to negative cash flow in 1Q17, led by seasonal inventory build-up. The company had cash outflows of $928 million in the form of capital expenditure or capex and $686 million in the form of dividends in 1H17.

PSX’s capex and dividend payments led to a cash outflow of around ~$1.6 billion in 1H17, resulting in a cash flow deficit, funded primarily by drawing down on cash reserves. PSX’s cash balance fell from ~$2.7 billion at the beginning of 1H17 to ~$2.2 billion at the end of 1H17.

Peer cash flows

In 1H17, Andeavor (ANDV) also witnessed a deficit in cash due to its acquisition activities. However, Valero Energy (VLO) and Marathon Petroleum (MPC) witnessed surpluses in their cash flows in 1H17. (For more details on refiner cash flow shortfalls and surpluses, check out Market Realist’s “Comparing Refiners’ Cash Flow in 1H17.”

What does Phillips 66’s cash flow analysis show?

Phillips 66 witnessed a lower cash flow from operations in 1H17, mainly due to the volatile refining environment, which led to an inventory pile-up in 1Q17. However, PSX’s cash flow from operations rose in 2Q17.

PSX is still experiencing a cash flow shortfall based on the above analysis, but with its diversified-growth-oriented earnings model, PSX could soon witness a cash flow surplus. So far in 3Q17, the refining environment looks better.

Meanwhile, Hurricane Harvey has boosted refining cracks, and this could lead to higher earnings in 3Q17—assuming steady volumes. If earning rise, cash flows could improve, leading to a better liquidity position.

We’ll discuss Phillips 66’s growth plans in the next part of the series.