Nike Rating Lowered on Concerns of Rising Competitive Pressure

Nike (NKE), the world’s largest apparel company and America’s leading sportswear brand, faced analyst downgrades and target price revisions in September.

Dec. 2 2019, Updated 10:11 a.m. ET

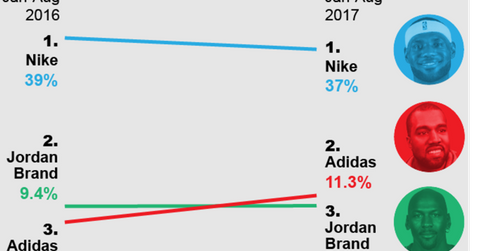

Adidas overtakes Nike’s Jordon Brand for the number-two position

Nike (NKE), the world’s largest apparel company and America’s leading sportswear brand, faced analyst downgrades and target price revisions in September as Adidas (ADDYY) officially acquired the number-two spot in the American sportswear market.

Adidas, which until recently stood at the number-three position, overtook Jordon Brand (owned by Nike) during the first eight months of the year. According to recent data from NPD Group, Adidas, with an 11.3% average monthly market share, beat Jordan Brand, with a 9.5% market share. The Nike brand continues to dominate the US footwear market with a 37% market share.

Recent analyst action on Nike

On September 19, Susquehanna lowered Nike to “Neutral” from a “Buy” rating on concerns of weakness in the basketball business. Analyst Sam Poser said, “There’s an oversupply of basketball product in North America which will pressure sales and margins.” He added, “Near term lack of innovation in select categories is hurting performance worse than anticipated.” The analyst reduced Nike’s target price by more than 15% to $54.00 (from $64.00).

Deutsche Bank, however, reiterated its “Buy” rating on Nike. Analyst Paul Trussell commented, “We recommend investing in brands that have global appeal and growth opportunities, strong DTC & e-commerce efforts, pricing power, and long-term margin drivers. NKE checks each box when the product is innovative. Retailer commentary clearly showcases that excitement has been lacking but we blame strategic missteps more than channel competition. With new platforms, the NBA deal, and World Cup ahead, we look for a stronger 2018.” Trussell, however, lowered Nike’s target price to $61 from $69.

Other brokerage houses that reduced Nike’s price target in September included Cowen and Company (from $54 to $53), Raymond James (from $71 to $67), Jefferies (from $60 to $49), and HSBC (from $64 to $62).

The average 12-month price target from 37 analysts on Nike is $60.31, indicating an upside of ~13% over the next year.

ETF investors seeking to add exposure to NKE can consider the SPDR Dow Jones Industrial Average ETF (DIA), which invests ~2% of its portfolio in NKE.

Read on to learn about the recent analyst action on Nike’s close competitor Under Armour (UAA).