Kansas City Southern: What Led Volume Rise in Week 34?

Kansas City Southern (KSU), the smallest Class I railroad, reported a marginal volume gain in the week ended August 26, 2017.

Sep. 4 2017, Updated 9:07 a.m. ET

KSU’s railcars in week 34

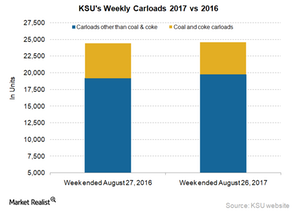

Kansas City Southern (KSU), the smallest Class I railroad, reported a marginal volume gain in the week ended August 26, 2017. KSU’s overall railcar volumes rose to ~25,000 carloads in the same week compared with over 24,000 railcars in the week ended August 27, 2016.

The rise in overall volumes was limited by a 7.8% decline in coal (CNX) and coke volumes in week 34 of 2017. From around 5,300 carloads in the same week last year, these railcars were 4,800 in the reported week of 2017. The carloads other than coal and coke jumped 3% to ~20,000 railcars from 19,000 plus railcars a year before.

KSU’s marginal rise in railcars in week 34 of 2017 was in line with the growth reported by US railroads in the same category.

Change in commodity groups

In the 34th week of 2017, commodities with a positive change in volumes were grain, crushed stone, sand and gravel, stone, clay and glass products, and iron & steel products. On the other hand, grain mill products, food and kindred products, chemicals, petroleum products, as well as metals and products reported a negative change in volumes.

KSU’s intermodal volumes

In the week ended August 26, 2017, Kansas City Southern registered a 4% rise in intermodal units. KSU hauled ~20,000 containers and trailers in the same week compared with over 19,000 units in the week ended August 27, 2016.

The company’s container volumes expanded while trailer traffic contracted in the reported week of 2017. From 19,000 containers in week 34 last year, volumes jumped 4.1% to ~20,000 containers in the same week of 2017. Containers dominate KSU’s intermodal traffic mix accounting for ~98% of the traffic. KSU’s trailer volumes, however, fell 4.8% to 260 units in week 34 of 2017 compared with 270 units in the same week last year.

If you are interested in exposure to blue chips included in the S&P 500, consider investing in the Guggenheim S&P 500 Equal Weight ETF (RSP). All US-originated Class I railroads (UNP) are included in the portfolio holdings of RSP.

Continue reading to learn about Canadian National Railway’s (CNI) freight volumes.