H.B. Fuller to Acquire Royal Adhesives and Sealants

On September 4, 2017, H.B. Fuller (FUL) announced that it has entered into an agreement to acquire Royal Adhesives and Sealants.

Sep. 12 2017, Published 7:44 a.m. ET

H.B. Fuller to acquire Royal Adhesives and Sealants

On September 4, 2017, H.B. Fuller (FUL) announced that it has entered into an agreement to acquire Royal Adhesives and Sealants. The deal is valued at $1.575 billion. H.B. Fuller intends to finance the deal through new debt. As part of the deal, H.B. Fuller will get Royal Adhesives and Sealants’ 19 manufacturing facilities in five countries. H.B. Fuller estimates that Royal Adhesives and Sealants will generate ~$650 million in revenue and $138 million in adjusted EBITDA during H.B. Fuller’s fiscal 2017.

The acquisition is expected to bring cost synergies of $35 million and another $15 million in growth synergies over the next three years. Once the deal is completed, H.B. Fuller expects its revenue to be ~$2.9 billion. The acquisition will also increase H.B. Fuller’s presence in North America, Europe, and China.

Jim Owens, H.B. Fuller’s president and CEO said, “This accretive acquisition accelerates realization of our 2020 strategic objective to focus and grow in engineering adhesives and other highly specified market segments, while exceeding our targeted cash flow, EPS and EBITDA margin targets.”

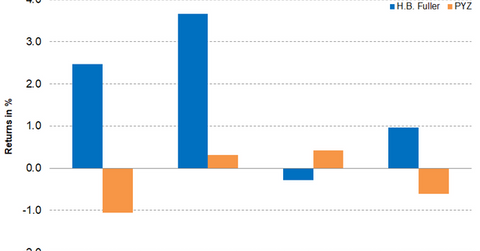

H.B. Fuller’s stock performance

H.B. Fuller stock made huge gains for the week ending September 8, 2017. H.B. Fuller rose 7.0% and closed at $54.21. The gain in the stock price caused the stock to trade 5.20% above the 100-day moving average price of $51.51, which indicates a trend reversal. Analysts expect H.B. Fuller’s stock price to be at $58.00 over the next 12 months, which implies a return potential of 7.0% from its closing price on September 8. H.B. Fuller’s 14-day relative strength index of 71 indicates that the stock has temporarily moved into the overbought zone.

Investors looking to invest indirectly in H.B. Fuller can invest in the PowerShares DWA Basic Materials Momentum Portfolio (PYZ). PYZ has invested 1.20% of its portfolio in H.B. Fuller. The fund has also invested in Chemours (CC), Albemarle (ALB), and FMC (FMC) with weights of 5.0%, 3.8%, and 4.70%, respectively, as of September 8, 2017.