Behind Halliburton’s Free Cash Flow, Capex, and Acquisition Strategies

Halliburton’s (HAL) CFO (cash from operating activities) in 2Q17 showed a remarkable improvement over 2Q16. HAL’s CFO was a $346 million in 2Q17.

Sep. 8 2017, Updated 7:36 a.m. ET

HAL’s operating cash flows

Halliburton’s (HAL) CFO (cash from operating activities) in 2Q17 showed a remarkable improvement over 2Q16. HAL’s CFO was a $346 million in 2Q17, compared with -$3.6 billion one year previously.

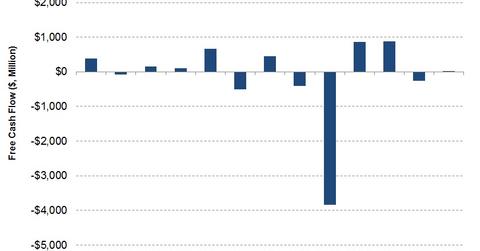

Halliburton’s free cash flow

HAL’s capital expenditure or capex rose 54% from 2Q16 to 2Q17. However, a much sharper rise in CFO offset this capex growth, and so Halliburton’s FCF (free cash flow) turned positive in 2Q17.

In 2Q17, HAL’s FCF totaled $19 million, compared with -$3.8 billion one quarter previously. Halliburton’s FCF has been negative for five of the past 13 quarters.

By comparison, TechnipFMC’s (FTI) CFO was $143 million in 2Q17. Weatherford International’s (WFT) 2Q17 CFO was -$62 million, while Nabors Industries’ (NBR) CFO was $48 million in 2Q17. (Read more about oilfield services companies’ FCFs in Market Realist’s series Oilfield Services Stocks: Free Cash Flow Winners and Losers.)

HAL’s capex and acquisition plans

In 2017, Halliburton expects to spend $1.3 billion in capex, which would be 63% higher than in 2016. The company plans to spend on the conversion of its hydraulic fracturing fleet to Q10 pumps (required in shale fracturing) and reactivating cold stacked pressure pumping equipment. HAL’s management also expects “improvement in our earnings in a number of working capital initiatives” to augment its CFO flow in the remainder of 2017.

In July 2017, Halliburton acquired Summit ESP, which provides ESP (electric submersible pump) technology and services. In July, HAL also acquired Ingrain and Optimization Petroleum Technology. In 3Q17, HAL expects to pay $630 million in aggregate on acquisition-related payments. Higher capex and acquisitions could put pressure on Halliburton’s FCF generation in 2017.

Notably, Halliburton makes up 2.1% of the iShares North American Natural Resources ETF (IGE). Since June 30, 2017, IGE has risen 1%, compared with the 9% fall in HAL’s stock price.

In the next and final part of this series, we’ll discuss Halliburton’s dividends and dividend yield.