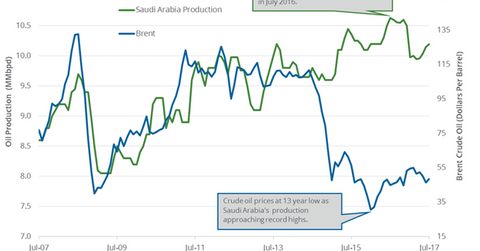

Will Saudi Arabia’s Production and Exports Support Crude Oil Futures?

The EIA (U.S. Energy Information Administration) estimates that Saudi Arabia’s crude oil production rose by 50,000 bpd (barrels per day) to 10.20 MMbpd (million barrels per day) in July 2017 compared to the previous month.

Nov. 20 2020, Updated 12:44 p.m. ET

Saudi Arabia’s crude oil production

The EIA (U.S. Energy Information Administration) estimates that Saudi Arabia’s crude oil production rose by 50,000 bpd (barrels per day) to 10.20 MMbpd (million barrels per day) in July 2017 compared to the previous month. Production rose 0.5% month-over-month but fell 4% year-over-year. Saudi Arabia’s production is at the highest level since the implementation of OPEC’s deal in January 2017. As per the deal, major oil producers have to reduce crude oil production by 1.8 MMbpd from January 2017 to March 2018.

Any rise in production from Saudi Arabia has a negative impact on crude oil (ERY) (ERX) (FENY) prices. Lower crude oil prices have a negative impact on oil producers. The energy sector’s top losers as of August 21, 2017, are mentioned below:

Saudi Arabia’s crude oil exports

Saudi Arabia’s crude oil exports fell by 35,000 bpd to 6.89 MMbpd in June 2017 compared to the previous month, the lowest in the last 33 months.

Saudi Arabia’s crude oil inventories

Saudi Arabia’s crude oil inventories are at 257 million barrels in June 2017, the lowest level since January 2012. The rise in domestic consumption due to the summer season led to the fall in inventories. Crude oil is used for generating electricity. Hot temperatures during the summer drive air conditioning usage, which leads to a rise in electricity and crude oil consumption.

Saudi Arabia’s export plans

Saudi Arabia is expected to cut its crude oil exports to 6.6 MMbpd in August 2017, one MMbpd lower than in the same period in 2016. The cut would remove excess oil from the market. For more on OPEC’s crude oil production and exports, read the previous part of the series.

Saudi Arabia is expected to cut exports 10% to North Asian refiners in September 2017 due to the OPEC deal. Countries like China and India may increase their imports from the US and Iran if Saudi Arabia continues to decrease its supplies. Saudi Arabia may lose its market share due to OPEC’s deal to reduce crude oil production by 1.8 MMbpd from January 2017 to March 2018.