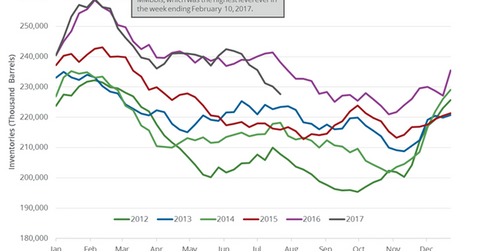

US Gasoline Inventories Limit the Upside for Crude Oil Futures

US gasoline inventories rose by 3.4 MMbbls to 231.1 MMbbls on July 28–August 4, 2017. Inventories rose for the third time in the last ten weeks.

Aug. 10 2017, Published 9:51 a.m. ET

US gasoline inventories

The EIA (U.S. Energy Information Administration) reported that US gasoline inventories rose by 3.4 MMbbls (million barrels) to 231.1 MMbbls on July 28–August 4, 2017. Inventories rose for the third time in the last ten weeks. US gasoline inventories rose 1.5% week-over-week but fell by 4.2 MMbbls or 1.8% YoY (year-over-year).

A market survey estimated that US gasoline inventories would have fallen by 1.5 MMbbls on July 28–August 4, 2017. A surprise rise in gasoline inventories limited the upside for US crude oil (ERY) (ERX) (USO) futures. US gasoline futures were flat on August 9, 2017, despite a rise in gasoline inventories. They were flat at $1.62 per gallon on August 9, 2017.

Volatility in crude oil and gasoline prices impact refiners and producers’ earnings like Tesoro (TSO), Valero (VLO), Warren Resources (WRES), and Carrizo Oil & Gas (CRZO).

US gasoline production, imports, and demand

US gasoline production rose by 6,000 bpd (barrels per day) to 10.30 MMbpd (million barrels per day) on July 28–August 4, 2017. Production rose 0.1% week-over-week and by 210,000 bpd or 2.1% YoY.

US gasoline imports rose by 549,000 bpd to 1,108,000 bpd on July 28–August 4, 2017. Imports rose 102% week-over-week and by 178,000 bpd or 19% YoY.

US gasoline demand fell by 45,000 bpd to 9.7 MMbpd on July 28–August 4, 2017. Demand fell 0.5% week-over-week but rose by 28,000 bpd or 0.3% YoY.

US gasoline demand hit 9.8 MMbpd for the week ending July 28, 2017—the highest level ever.

Impact of gasoline inventories

US gasoline inventories are below their five-year range for the week ending August 4, 2017. Inventories have fallen ~4% in the last eight weeks. Inventories are expected to fall until the end of the summer. It would benefit gasoline prices and support crude oil (DIG) (RYE) (VDE) prices.

In the next part of this series, we’ll analyze US distillate inventories.