Sanofi Genzyme Continues Driving Revenue Growth in 2Q17

Sanofi Genzyme In 2Q17, Sanofi Genzyme (SNY) reported revenue growth of 13.5% to 1.7 billion euros. Considering a constant structure and constant exchange rates, the growth was 14.4%. Sanofi Genzyme, which includes product revenue from the multiple sclerosis, rare disease, oncology, and immunology franchises, reported a sales increase of ~14.6% to 1.7 billion euros. This rise was […]

Aug. 17 2017, Updated 9:07 a.m. ET

Sanofi Genzyme

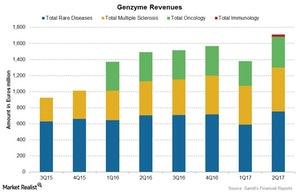

In 2Q17, Sanofi Genzyme (SNY) reported revenue growth of 13.5% to 1.7 billion euros. Considering a constant structure and constant exchange rates, the growth was 14.4%.

Sanofi Genzyme, which includes product revenue from the multiple sclerosis, rare disease, oncology, and immunology franchises, reported a sales increase of ~14.6% to 1.7 billion euros. This rise was driven by the strong performance of multiple sclerosis drugs Aubagio and Lemtrada, rare disease drugs Fabrazyme, Myozyme, and Cerdelga, and oncology drugs Jevtana and Mozobil.

Multiple sclerosis

The multiple sclerosis franchise’s revenue rose 27.9% at constant exchange rates to 549 million euros in 2Q17. Aubagio, a once-daily oral drug for relapsing remitting multiple sclerosis, reported 32.7% growth to 425 million euros in 2Q17, driven by strong performance worldwide. Lemtrada, another drug for the treatment of relapsing forms of multiple sclerosis, reported 14.6% growth to 118 million euros, driven by increased demand worldwide.

Rare diseases

The rare disease franchise includes Cerezyme, Aldurazyme, Cerdelga, Myozyme, and Febrazyme. The franchise reported 5.9% revenue growth at constant exchange rates to 752 million euros in 2Q17. The revenue growth was driven by all drugs except Cerezyme.

Oncology

The oncology franchise reported 4.4% revenue growth at constant exchange rates to 383 million euros in 2Q17. The growth was driven by strong sales of Jevtana, Thymoglobulin, Zaltrap, Eloxatin, and Mozobil, and was partially offset by Taxotere.

Immunology

The immunology franchise, which comprises drugs Dupixent and Kevraza, reported revenue of 27 million euros in 2Q17. To divest company-specific risks, investors could consider the PowerShares International Dividend Achievers ETF (PID) which has a 1.4% exposure to Sanofi (SNY). PID also has a 1.5% exposure to Novartis (NVS), a 1.2% exposure to Novo Nordisk (NVO), and a 1.0% exposure to Teva Pharmaceutical Industries (TEVA).