How Priceline Can Grow Its Revenue in 2017

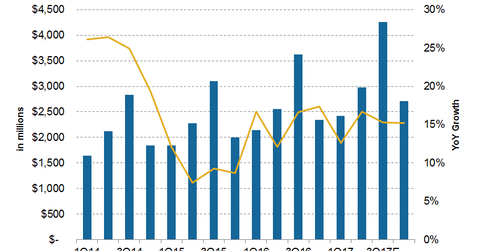

For 2Q17, analysts are estimating that Priceline’s (PCLN) revenue will rise 16.7% YoY to $3.0 billion, which is higher than 12.6% in 1Q17.

Aug. 3 2017, Updated 2:35 p.m. ET

Analyst estimates

For the second quarter of 2017, analysts are estimating that Priceline Group’s (PCLN) revenue will rise 16.7% YoY (year-over-year) to $3.0 billion, which is higher than the 12.6% YoY rise in the first quarter of 2017. For 2017, analysts are estimating revenue to grow 15.5% to $12.4 billion, which is slightly lower than the 16.5% YoY growth in 2016. However, what’s keeping the stock’s momentum up is that analysts are estimating that Priceline will have a 15.0% compound average annual growth for the next four years.

Strong European environment to help

In its second quarter earnings call, Expedia management reiterated the strong growth momentum it’s seeing in Europe. That also bodes well for Priceline, which earns the majority of its revenue from Europe. It also recently completed the acquisition of Momondo, which is based in Europe. Momondo owns the highly successful Cheapflights brand. The acquisition will further strengthen Priceline’s growth.

Untapped potential

Priceline’s new CEO (chief executive officer) Glenn Fogel believes the company still has a lot of untouched opportunities in key markets such as the United States and China. The online booking penetration in China is extremely low, which points to a huge growth potential. Also, rising income levels in these countries will provide additional impetus to travel. In the United States, more people are traveling, which will help Priceline’s growth.

You can gain exposure to Priceline stock by investing in the PowerShares DWA Consumer Cyclicals Momentum ETF (PEZ), in which PCLN has the highest weight of ~4.6%. PEZ also holds 3.3% in Expedia (EXPE). However, it has no exposure to other online travel stocks, including TripAdvisor (TRIP) and Ctrip.com International (CTRP).