Can Edwards Intuity Elite Boost Edwards Lifesciences’ Revenues?

With the Edwards Intuity Elite valve system, Edwards Lifesciences aims to offer a minimally invasive therapy to complex aortic stenosis patients.

Aug. 2 2017, Updated 4:35 p.m. ET

Growth opportunity

Edwards Lifesciences (EW) expects to witness an increased demand for its surgical aortic valves in markets that are less penetrated by TAVR (transcatheter aortic valve replacement) therapy. The company also expects younger active patients, especially those with mechanical valves and those undergoing complex and combined procedures, to be the key target market for its surgical aortic valves.

Edwards Lifesciences also expects to benefit from an increased demand for the mitral valve replacement procedure. The company has projected a rising demand for beating heart bypass surgery in 2017.

The focused commercial strategy for the Surgical Heart Valve Therapy segment is expected to enable Edwards Lifesciences to compete effectively with other surgical aortic valve replacement players such as Abbott Laboratories (ABT), Medtronic (MDT), and Boston Scientific (BSX).

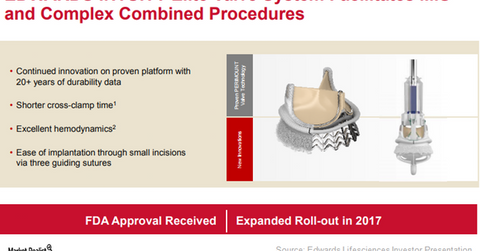

The above diagram explains the superior characteristics of the Edwards Intuity Elite Valve System in detail.

Edwards Intuity Elite valve system

With the Edwards Intuity Elite valve system, which was approved by the FDA (U.S. Food & Drug Administration) in August 2016, Edwards Lifesciences aims to offer a minimally invasive therapy to complex aortic stenosis patients who may require multiple surgical procedures at the same time. The company is confident that by 2018, the Edwards Intuity Elite valve system will account for about 10.0% of Edwards Lifesciences’ sales from its aortic valve portfolio.

Inspiris Resilia

On July 5, 2017, Edwards Lifesciences secured FDA approval for Inspiris Resilia, an innovative resilient heart valve specially designed for active and younger patients seeking alternative options to mechanical valves. There are around 25.0% aortic valve replacement patients globally who are currently being treated with mechanical valves.

This valve was already launched in Europe in 2017, while commercial launches in the United States and Japan are planned for 2018. If this first valve in the upcoming class of resilient valves receives a positive response in the United States and Japan like it has in Europe, it may benefit Edwards Lifesciences stock as well as the stock of the iShares Russell Mid-Cap Growth (IWP). Edwards Lifesciences makes up about 0.86% of IWP’s total portfolio holdings.

In the next part of this series, we’ll look at innovative surgical aortic valves being developed by Edwards Lifesciences.