Dividend Yield of Franklin Resources

Franklin Resources (BEN) has recorded consistent growth in dividends since at least March 1982.

Aug. 23 2017, Published 12:43 p.m. ET

Franklin Resources: Financial sector, asset management industry

Franklin Resources (BEN) is a comprehensive investment firm that invests in public equity, fixed income, and alternative markets. Revenues for fiscal 2016 and fiscal 2015 fell due to a decline in its reportable segments; namely, investment management fees, sales and distribution fees, and shareholder servicing fees. Operating income fell due to a decline in revenue despite lower operating expenses. Higher interest expenses further propelled its EPS (earnings per share) to fall, partially offset by share buybacks.

Revenue for the first nine months of 2017 has fallen due to a decline in all the segments. The investment management fees segment was the only segment to record some growth in 3Q17. A fall in operating expense couldn’t salvage the fall in operating income. EPS managed to grow, driven by investments and other income and share buybacks.

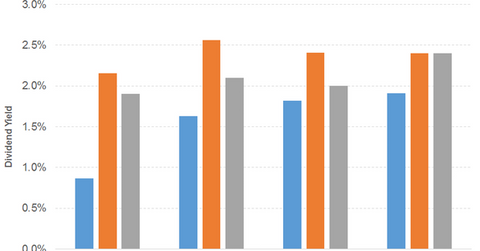

Below we can see Franklin Resources’ dividend yield compared to the S&P 500 and BlackRock (BLK). (The asterisk in the graph denotes an approximation in calculating dividend yield.)

Consistent dividend growth

The company has recorded consistent growth in dividends since at least March 1982. Free cash flow fell in fiscal 2016 with a fall in net income. Its dividend yield has recorded a growing trend over the years.

The company’s PE (price-to-earnings) ratio of 14.2x compares to a sector average of 17.1x. The dividend yield of 1.9% compares to a sector average of 4.9%. Below we can see Franklin Resources’ price movement compared to the S&P 500 and BlackRock.

Franklin Resources continues to lengthen its list of actively managed ETFs, thus enhancing its average AUM (assets under management) figures. It intends to introduce its assortment of ETFs in Europe in 2017.

The First Trust Value Line Dividend ETF (FVD) offers a dividend yield of 2.1% at a PE ratio of 20.4x. The diversified ETF has a substantial exposure to utilities. The Schwab US Dividend Equity ETF (SCHD) offers a dividend yield of 2.9% at a PE ratio of 20.3x. The diversified ETF has a substantial exposure to consumer non-cyclical.